What is ACCA?

The economic development of any country is dependent on transparency and sound reporting to foster a cohesive investment-based environment and inspire investor confidence while attracting international investment opportunities. This not just helps in financial stability but also curtails corruption and mismanagement of resources.

This is where strong accountancy manpower comes in. Trained accountants help in developing dynamic businesses that deliver long-term value while maintaining transparency and accountability.

ACCA is the world’s oldest and most credible qualification for creating that much-needed strategic accounting infrastructure, which is critical for the growth of any business irrespective of its scale and industry.

Standing for the Association of Chartered Certified Accountants, ACCA is the world’s largest and oldest accounting association formed in the UK in 1904. It is the world’s first and fastest entryway into the critical function of both financial and management accounting.

ACCA has a network of around 117 offices and 500,000 members and students in almost 180 countries in the world. After completing this qualification, this regulatory body offers you the Chartered Certified Accountant designation. This course not just helps you prepare for any financial and management aspect of a business, but also prepares you for work in any corner of the world and qualified and valued professionals.

What do you get by doing ACCA?

Who should pursue the ACCA program?

HSC Students interested in Accounting career

With its flexible learning and student-friendly examination systems, it gets you off the block. It also equips you for roles beyond accounting to build a long-term career.

Graduating students interested in Accounting Careers

Since you get several exemptions, the program is a faster and cheaper way for you to prepare for multiple roles and to open doors of multinational companies.

Experienced Professionals

ACCA will refresh the concepts and prepare you for strategic roles increasing your career enhancement prospects.

Want to know if ACCA is the right career choice for you? Take this short quiz now

The minimum eligibility criteria for pursuing ACCA is:

- Passed 10+2 with a score of 65 per cent in English and Mathematics/Accounts. Minimum 50 per cent in other courses.

- Students who have recently passed their 10th standard examination can sign up for ACCA through the FIA (Foundation in Accountancy).

>An important feature of ACCA is that, unlike in CA, you are allowed exemptions. This means that if you have existing qualifications or training, you may not have to take all the exams to get the ACCA qualification.

You may start your studies at the right level based on your existing knowledge and skills.

An exemption is awarded only when you have received the related qualification recently. Your past qualification must not go back further than a decade. Remember that exemptions will be available only on recognised qualifications and you can receive credit points if your course has more than one topic covered in two different places in the exemption requirements.

Let’s look at ACCA exemptions in more detail:

| Qualification | Exams to give | Exemptions |

| 12th standard completion | 13 | 0 |

| Commerce graduate | 9 | 4 |

| M.Com | 9 | 4 |

| CA IPCC (Both groups) | 8 | 5 |

| CA | 4 | 9 |

Eager to know which exemptions you are eligible for?

Countries where ACCAs have signing authority

As a member of the ACCA, you have signing authority in most countries. You can sign audit reports and do self-practice in countries such as:

- The United Kingdom

- Canada

- Australia

- New Zealand

- Singapore

- The UAE

- Germany

- South Africa

- Switzerland

- Turkey

Remember, that you don’t have signing authority in India and cannot set up your own practice here. However, you can work with any audit firm including those in the Big 4 and other MNCs.

Why should you pursue ACCA?

A and a chartered accountant has tremendous benefits. ACCA certification is a gold standard in accountancy that rewards you with exciting global exposure and a great salary package.

Let’s look at some great reasons to pursue the course:

A great alternative to CA

One of the top benefits of ACCA is that it is an excellent global alternative to CA. ACCA is a globally-recognised degree and opens up work opportunities for you in more than 170 countries. CA on the other hand is a specialisation in Indian taxation and accounting systems. These may not hold well while applying for jobs outside India.

Another reason is that the CA course is considered harder than ACCA. While the global passing rate of ACCA is between 55-60 per cent, that of CA is usually around 8-10 per cent.

You stand out from the crowds

One of the greatest reasons why this course is worth your time is that this qualification equips you with critical skills and knowledge. You get trained in the most relevant and applicable subjects of corporate accounting, finance, business law, and much more.

Not just this, the course also polishes your leadership, communication, and strategy skills to make you a well-rounded professional.

You gain the potential to earn more

Another plus of the ACCA qualification is that it assures your prospective employer of your skills and that you meet the best industry standards. When you are more valuable as compared to non-ACCA candidates, you can gain a higher pay package easily.

You get to be a part of a niche community

When you become an ACCA member, you automatically get connected to lacs of existing members worldwide. These like-minded individuals offer their expertise and expand your horizons tremendously. This also keeps you abreast of the latest happenings in your profession and helps shape your ideas.

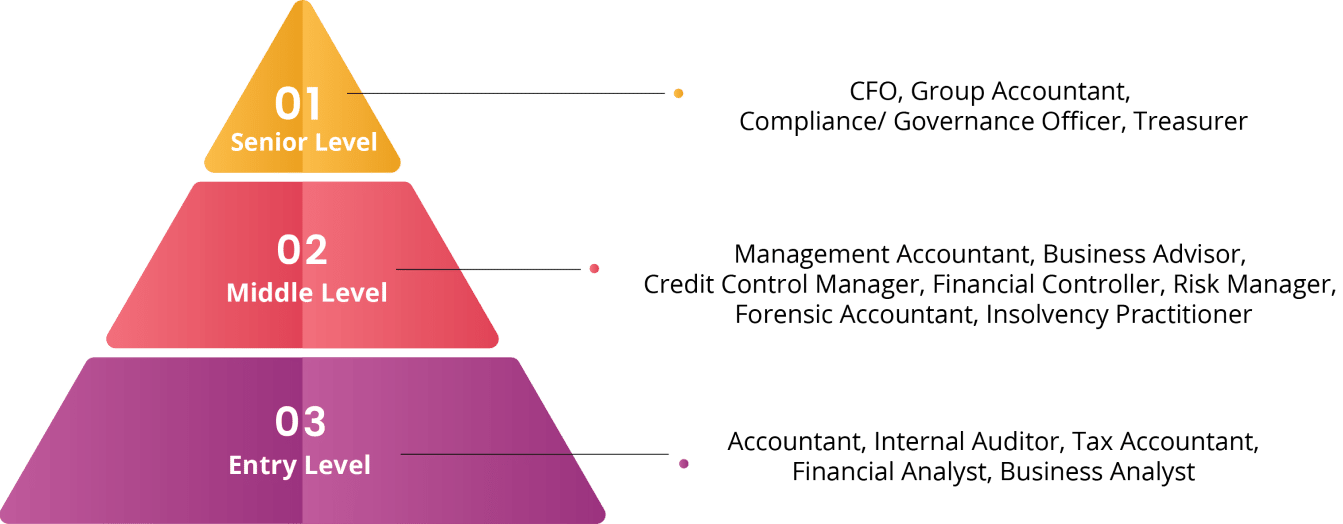

What are the potential job roles after ACCA qualification?

ACCA opens up excellent job opportunities for students. Let’s take a look at some of the roles that you can take up:

Management accountant

You will be responsible for identifying, evaluating, and measuring the business and operational costs of your organisation. This information is essential to help the business stay on track and take critical decisions.

Financial accountant

You are mainly responsible for recording and analysing the financial transactions of an organisation. These statements may be presented to creditors, investors, and other stakeholders.

Credit controller

A credit controller’s main responsibility is to manage the corporate debtors and ensure credit recovery. You will also evaluate and approve new credit applications and check the credit ratings of the customers with the bank.

Finance manager

As a finance manager, you will be responsible for managing all the aspects of the finance division. You will be required to do financial analysis and management accounting by creating business reports and financial statements. You may also have to find avenues for cost reduction and assess market trends to identify investment opportunities.

Tax specialist

A tax specialist’s role is to advise their clients on tax laws and meet all their taxation requirements.

ACCA salaries: India and worldwide

Over the past few years, the scope of the ACCA qualification has increased tremendously. Candidates who complete ACCA and demonstrate the necessary skills are usually hired by companies such as:

- EY

- Grant Thornton

- PwC

- Deloitte

- KPMG

- PepsiCo

- HSBC

- Accenture

The ACCA qualification is one of the most sought-after career options mainly because of the lucrative monetary benefits that it offers. Depending on your role, experience, country of work, and other factors, your average remuneration can range between:

| Country | Entry level | Mid-level | Senior level |

| India | INR 7.00 lac | INR 11.17 lac | INR 19.00 lac |

| UK | GBP 39,000 | GBP 52,500 | GBP 68,200 |

| UAE | AED 60,000 | AED 1,20,000 | AED 2,40,000 |

| Hong Kong | HKD 17,400 | HKD 22,800 | HKD 31,900 |

Is ACCA a degree?

ACCA itself isn’t the conventional undergraduate degree that you really get. But ACCA fundamental level gives you the knowledge and applied skills that could be considered equivalent to a bachelor’s degree. The professional level is considered equivalent to a master’s degree. But overall, ACCA isn’t a conventional degree. It is a professional certification.

Scope Of ACCA in India

Most of the ACCA-qualified professionals in India are employed with the Big 4s or MNCs. Employers in India have now become aware of ACCA qualifications and are hiring them eagerly. The leading employers in India for ACCA are Price Waterhouse Coopers, Ernst and Young, Deloitte, KPMG, TATA Communications, Embassy Group, Grant Thornton, etc. CA and ACCA members are increasingly offered similar job profiles, designations and salary packages.

India has taken another step closer towards globalisation by introducing Ind-AS drafted and implementing principles identical to IFRS. ACCA covers IFRS broadly in its syllabus, giving ACCA members in India an edge.

With many financial KPOs in India, India has become a central outsourcing hub for accounting and financial functions. Employers prefer ACCA-qualified professionals for handling these functions.

In India, the salary offered to ACCA fresher students or members is between INR 3,00,000 to INR 8,00,000.

Interested in pursuing ACCA course in India? Click Here

What are the 13 subjects in ACCA?

To qualify as an ACCA member, a candidate must do the following:

-

-

- Attempt and clear 13 exams (ACCA does provide up to 9 paper exemptions depending upon the candidate’s previous qualification)

- Record 36 months’ experience in a relevant role. The candidate can acquire the experience before/ during/ after completion of the qualification. Complete the Ethics and Professional Skills module.

- The 13 subjects and exams are divided into three levels: Applied Knowledge, Applied Skills & Strategic Professional.

-

Now let’s deep dive into each of the ACCA levels

Applied Knowledge Level:

-

-

- Business and Technology (BT)

- Management Accounting (MA)

- Financial Accounting (FA)

-

Students are awarded the ACCA Diploma in Accounting and Business (RQF Level 4) when they have successfully completed the Business and Technology (BT), Management Accounting (MA) and Financial Accounting (FA) exams (at least one of which must have been sat and passed), plus completion of Foundations in Professionalism.

Applied Skills Level:

Subjects in the Applied skills level include

-

-

- Corporate and Business Law(LW)

- Performance Management

- Taxation (TX)

- Financial Reporting (FR)

- Audit and Assurance (AA)

- Financial Management (FM)

-

Students are awarded the Advanced Diploma in Accounting and Business when they have successfully completed (either passed or exempt) the Applied Skills exams. At least two of these papers must have been sat and passed.

Strategic professional Level:

Students need to prepare for 4 subjects out of 6. They are divided into essential and optional modules

Essentials:

-

-

- Strategic Business Leader(SBL)

- Strategic Business Reporting(SBR)

-

Options: (Any 2)

-

-

- Advanced Financial Management (AFM)

- Advanced Performance Management (APM)

- Advanced Taxation (ATX)

- Advanced Audit and Assurance (AAA)

-

Students are awarded a Strategic Professional Certificate when they have successfully completed all the Strategic Professional exams of the ACCA Qualification. These are the two Strategic Professional Essentials exams and any two of the Strategic Professional Options exams.

Read – 6 Most Important Benefits of ACCA Course

Ethics and Professional Skills Module

Students are required to complete 20 hrs of the Ethics and Professional Skills Module, which develops the complete range of skills that employers demand.

By introducing students to the full spectrum of advanced ethical and professional skills and exposing them to realistic business situations, students are ready to shine with recruiters and be really credible in the workplace.

Practical Experience Requirement

To qualify as an ACCA member, the candidate must complete a minimum of 36 months of relevant work experience and achieve 9 performance objectives.

A practical experience supervisor must sign off the candidate’s time in a relevant role and performance objectives.

Have Questions Related To ACCA?

Exam Details

| Foundations Level | Applied Knowledge Level | Applied Skills Level | Strategic Professional Level | |

| Exam Duration | 2 hours | 2 hours | 3 hours | 4 hours |

| Passing Marks | 50% | 50% | 50% | 50% |

| Total Marks | 100 | 100 | 100 | 100 |

When are the ACCA exams held?

ACCA has a flexible study approach & has two types of computer-based exams.

- On-demand CBEs: BT, MA, FA and LW: These exams can be taken any time of the year.

- Session CBEs: PM-FM: These exams are held in four exam sessions: March, June, September and December.

- Strategic professional CBE exams: Essentials and 2 options: These exams are held in four exam sessions: March, June, September and December.

How difficult is ACCA?

ACCA isn’t a difficult exam; it is easier to clear the ACCA compared to other professional finance and accountancy courses like the CA and CFA. It is more challenging than the school and undergraduate tests with which most students are familiar.

Essential skills needed in 2023 for ACCA students

A career in finance is extremely dynamic and rewarding. To create a great learning curve for yourself and be at the top of your job, there are certain skills that you need to inculcate.

Here are some of the most essential skills that an ACCA aspirant must possess:

Quantitative ability

You will be spending a lot of time crunching numbers from financial reports and real-time data. That’s not all, you will also need to have analytical skills to make sense of these numbers and offer important insights for your organisation to make critical business decisions.

Accounting knowledge

You need to have an aptitude for accounting laws, rules, and standards to help your business maintain its accounts.

Technical skills

Since most companies are moving towards digital technology, one of the most important skills for an ACCA aspirant is knowing how cloud technology works. You will also be expected to know about the software systems and tools that will make your job easier.

Here are some soft skills that are essential for an ACCA professional:

Good communication skills

ACCA professionals are expected to be great communicators because they don’t just analyse numbers but are also responsible for presenting them to the stakeholders. You will also be required to communicate with diverse teams to get your work done.

Decision making

A sharp judgement is essential to help your organisation make sound business decisions and prevent losses. You will be expected to analyse financial reports and offer sound advice for ensuring your business’s profitability.

Integrity

Ethical behaviour is the basis of any profession and not just ACCA. It is your role to maintain the highest degree of professionalism and transparency in your work. This skill becomes even more critical in today’s times when businesses have to adhere to new regulatory frameworks.

ACCA From IMS Proschool

The ACCA is an important qualification that offers you great career growth, competitive compensation, and opportunities for global exposure. However, to make this qualification count for you, you need an institute that ensures your learning is seamless and exemplary. IMS Proschool is dedicated to helping you achieve professional success by offering comprehensive course delivery, experienced faculty, and excellent placements. See how we can help you start your ACCA journey.

Advantages of enrolling with IMS Proschool

-

- 12000+ students trained in Accounting and Finance

- Students could save on registration fees and training costs

- IMS Proschool helps you in getting exemptions

- Classroom training available in 10 cities

- Exam pass commitment – Proschool offers unlimited classroom and doubt-solving sessions in case you fail ACCA Exams

- Extensive Pool Of Questions – Students solve 600+ questions for each of the ACCA subjects which helps them ace the exams easily.

- Faculty from Barclays, Standard Chartered, Crisil etc., with 80+ years of combined experience

- Financial Modelling worth Rs 40k free

- The batch starts every month

Want to become a Global CA? Why not start Today?

FAQ’s

Our Blog

Get an insight into the creativity of our team.