CIMA Course

What is CIMA?

CIMA (Chartered Institute of Management Accountants) established in the year 1919, is a globally recognized qualification for careers in Business & Finance? CIMA is the world’s largest professional body of Management Accountants with more than 250,000 members working in around 180 countries. CIMA-qualified professionals work in the field of Corporate Finance, Financial Reporting, Financial Analysis, Business Analysis, Project Finance, Treasury Management, Risk Management etc.

In collaboration with the CPA (USA) institute, CIMA members receive an additional designation- CGMA. CIMA has more than 4500 training and recruitment partners across the globe.

Management accountants analyze information to advise strategy and drive sustainable business success. Anyone can study the CIMA qualification, whether they’re new to finance and business or an experienced professional.

Why CIMA

CGMA

Since the tie up of CIMA & CPA which together give the CGMA Designation, your are sure to catch the eye of the recruiter

Networking

More than 4500 companies are the partner of CIMA around the world and 250000 members in around 180 countries, you get the advantage of exploring job opportunities or business opportunities.

Flexibility

CIMA has the flexibility for the students to study at their own pace and manage their work and study for optimum learning

Cost Effective

Registration, training and examination fee together can costs between Rs. 2 to 4 Lakhs depending upon your prior qualification.

Preferential Immigration Status

Due to the collaboration of CIMA with professional bodies CPA Australia, CIMA members get preferential immigration status abroad.

CIMA Career prospects

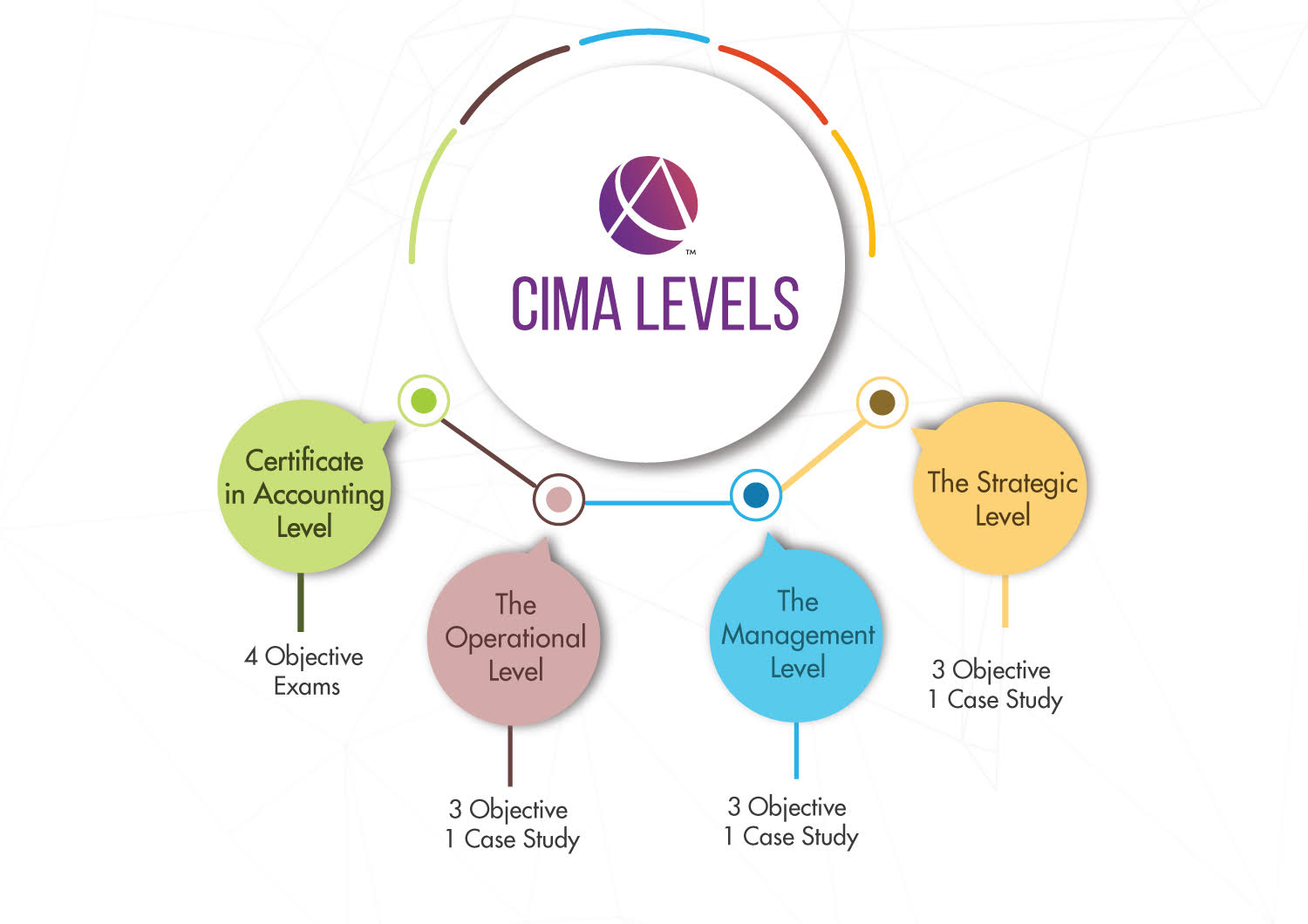

Course Structure

Based on background the student will enter the program from different routes.

Syllabus

Certificate Level

BA1– Fundamentals of Business Economics

BA 2– Fundamentals of Management Accounting

BA 3– Fundamentals of Financial Accounting

BA 4– Fundamentals of Ethics, Corporate Governance and Business Law

Exam: 4 Objective type Exams

Award: CIMA Certificate in business accounting CIMA cert BA

Operational Level

E1:Organizational Management

P1: Management Accounting

F1: Financial Reporting and Taxation

Exam: 3 Objective type Exams and 1 Case study Exam

Award: CIMA Diploma in management Accounting (CIMA dip MA)

Management Level

E2: Project and Relationship Management

P2 : Advanced Management Accounting

F2: Advanced Financial Reporting

Exam: 3 Objective Type Exams and 1 Case study Exam

Award :CIMA Advanced Diploma in Management accounting (CIMA ADV DIP MA)

Strategic Level

E3 Strategic Management

P3 Risk Management

F3 Financial Strategy

Exam: 3 Objective Type Exams and 1 Case study Exam

Exam Detail

Eligibility to learn the CIMA course, duration and entry route

Exam pattern in CIMA across all the levels –

| Objective type | Case study | |

| Exam at each level | 3 | 1 |

| Duration | 90 | 180 min |

| Paper type | Objective type | Integrated case study |

| Exam Frequency | Daily based on availability at Pearson Center | 4 times a year (Feb, May, Aug, Nov) |

| Result Declaration | Immediately | After 1 month of the exam |

Want to know more about CIMA Course by IMS proschool? Click here

FAQ’s

Our Blog

Get an insight into the creativity of our team.