Ever heard those tales that sound a lot like “Fingers crossed,” “Touch wood,” or even “A black cat crossed my path”?

If you’ve ever knocked on wood, crossed your fingers, or avoided the path of a black cat, you know how quirky superstitions can be. While they might add a bit of fun to our lives, superstitions won’t get you far in the world of Chartered Financial Analyst (CFA).

Setting the Record Straight on CFA Myths

Misconceptions about the path to becoming a Chartered Financial Analyst (CFA) are quite common. Let’s tackle these myths head-on and bring out the facts!

Importance of Accurate Information in Decision-Making

Accurate information is indeed the backbone of making sound financial decisions. Whether you’re aiming for a CFA or navigating the finance world, relying on verified knowledge is key. Let’s debunk some common CFA myths to ensure you’re on the right track to success.

Remember, it’s not about luck; it’s about knowledge and determination. Let’s dive in!

-

CFA Myth 1: CFA Requires a Finance Background

Debunking the Eligibility Myth

You might think a finance degree is necessary for a CFA, but that’s a myth. The CFA Investment Foundations® Program (CIFP) is your gateway. It welcomes all backgrounds into finance, valuing diverse perspectives in the industry. So, don’t let myths stop your journey into finance; CIFP is your starting point, regardless of your academic background.

The Role of the CFA Investment Foundations® Program (CIFP)

The CFA Investment Foundations® Certificate offers a comprehensive program covering finance, ethics, and investment concepts, beneficial for aspiring and supporting role professionals in finance. Enrolling at USD 350 provides access to six courses and a final assessment online for a year.

Benefits include:

- Enhanced Industry Understanding.

- Effective Communication with investment managers.

- Improved Vocabulary for asking relevant questions.

- Strengthened Professional Relationships.

- Clearer Role Comprehension within the industry landscape.

Program Structure:

- Six courses

- 60-90 hours of total study time

- Self-paced learning

- Progress tracking

- Ability to set study goals

- 12 months of access to coursework

- Engaging content

- A final assessment consisting of 100 multiple-choice questions

- A shareable certificate upon successful completion

Course Overview:

The Investment Foundations Certificate offers a diverse range of courses providing vital insights into the investment industry. From market structures and investment instruments to client needs, ethics, and ESG investing, this program provides essential knowledge. Enrolling in this certificate equips you with the necessary skills for success in finance and investments, irrespective of your background or experience.

Also Read – 6 Important CFA Updates & Curriculum Changes Announced in 2023

-

CFA Myth 2: CFA is More Difficult Than CA

The Truth About CFA vs. CA

What’s Tougher?

People love to compare, but CFA and CA are two professional courses, much like apples and oranges—completely different!

Now, CA exams are known for being pretty demanding. So, choose as per your aspirations, but remember, both require hard work and a lot of dedication.

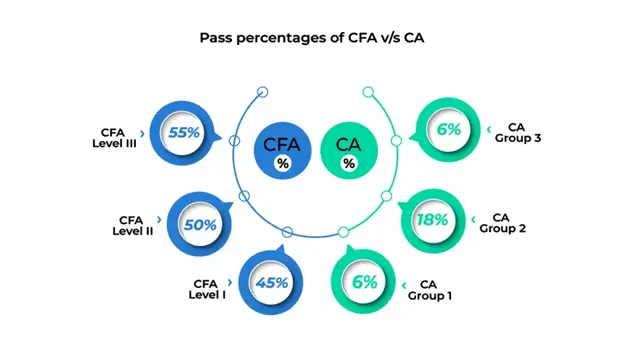

Passing Rates and Exam Comparisons: CFA vs CA

Fail one paper in a group, you’re back to square one. Mastering the CA or CFA exams isn’t easy—the CA has a mere 6% pass rate, and the CFA pass rates hover between 45% and 55%. Despite the difficulty, advancing through CFA levels gradually becomes more manageable, making the journey a rewarding pursuit.

CFA Exam Difficulty: The Real Deal

Are you still wondering just how tough the CFA exams are?

As per the UK NARIC, they have done a benchmarking exercise and put the CFA exams under the microscope. Here’s what they found:

- CFA Level 1 is as challenging as a Diploma (Level 5 in the UK’s Regulated Qualifications Framework, RQF.)

- CFA Level 2 is equivalent to a Bachelor’s degree (Level 6 on the RQF.)

- CFA Level 3 is comparable to a Master’s degree (Level 7 in the RQF hierarchy.)

RQF Level 8 means it’s as tough as a PhD program. So, if you clear all three CFA levels, you’re climbing a whole educational mountain!

Did you know, 65% Proschool Students pass the CFA exams with ease.

-

CFA Myth 3: MBA in Finance is Enough

The “MBA vs. CFA” showdown has puzzled many aspiring finance professionals. Many wonder if an MBA in Finance outweighs a CFA certification in the finance realm. The truth? An MBA is a broad business education, including finance, akin to a buffet serving various business aspects. On the flip side, the CFA is a specialized, deep dive into finance’s nuances—focusing on investments, analysis, and portfolio management. While an MBA is diverse, the CFA is the specialized choice for finance enthusiasts.

Let’s put this into perspective:

Picture yourself hiring for a crucial finance role in an investment firm, facing two candidates: one with an MBA in Finance, the other a CFA charter holder.

The MBA graduate is versatile, adept at diverse business tasks, but they lack the specialized edge needed for intricate investments.

On the flip side, the CFA charter holder is a financial specialist. Their expertise lies in detailed equity research, asset management, and risk analysis—perfect for managing client investments.

But wait, there’s more!

Why Investment Firms Crave CFAs

In the world of investments, firms seek experts who can navigate finance intricacies with precision. Here’s why the CFA is their ace:

- Global Gold Standard: Imagine hiring for an investment firm in London. An applicant holding a CFA charter from India speaks the universal language of finance. This globally recognized credential is your gateway to international finance.

- In-Depth Financial Know-how: A leading investment firm needs professionals skilled in analyzing financial statements and making data-driven decisions. The CFA program is their training ground, diving into investment analysis, portfolio management, and ethical standards.

In the ongoing ‘MBA vs. CFA’ saga, it’s not about one being better—it’s about your desired role. An MBA is your business map, while the CFA is your compass in finance’s intricate terrain. In the finance world, the CFA can unlock remarkable career doors.

Also Read – How CFA Program Helps You Run a Business

-

CFA Myth 4: CFA Program is Too Expensive

The “CFA program vs. your bank account” myth has held many aspiring financial experts back. The cost of pursuing the CFA charter might seem intimidating at first glance, but don’t let it deter you. Let’s debunk this myth and examine the cost-benefit equation of the CFA program.

Analyzing the Cost-Benefit of CFA

The CFA program does come with expenses—exam fees, study materials, and your time investment. But let’s talk returns:

- Higher Income: CFA charter holders often earn significantly more than non-charter holders, offsetting the initial costs quickly.

- Global Recognition: The CFA charter’s global prestige offers broader career prospects and access to higher-paying roles.

Without the CFA, earning around INR 3,60,000 annually; with the CFA, after an investment of approximately INR 1.9 to 2.1 lakhs, securing a job paying INR 6,50,000 annually, resulting in an additional income of INR 2,90,000 per year.

Efficient Time Management for CFA Aspirants

Beyond financial costs, the CFA program demands a significant time investment. Yet, it’s an investment in more than just knowledge:

- Time Management Skills: Juggling work, study, and personal life is challenging. But mastering this balance during the CFA journey benefits your career—think of it as an investment in your time-management skills.

- Better Study: Study smarter, not longer. Focus on key areas, use quality materials, and consider prep courses to maximize learning in less time.

In the ‘CFA vs. savings’ myth, the charter stands as a worthy investment. Despite upfront costs and time, its potential for higher salaries and global recognition makes it a wise financial choice. Remember, in finance, the CFA charter is a bet on long-term gains.

84% of our students recommend that you join us for your CFA Prep

-

CFA Myth 5: Additional Work Experience is Required

When it comes to debunking this myth, it’s crucial to understand the truth about the work experience requirement for the CFA designation. While the CFA Institute does mandate a certain amount of work experience, it’s essential to recognize that you can start earning this experience before or after passing the exams.

- Understanding the Work Experience Criteria: The CFA Institute mandates a minimum of 4,000 hours of relevant work experience for the CFA designation. However, you don’t need to gather all this experience before taking the exams.

- Recognizing Pre-CFA Work Experience: Prior financial roles involving investment decisions, financial analysis, or portfolio management could count towards meeting the work experience requirement.

Your journey might have already set you on the right path, making those hours applicable towards your goal.

Also Read – Do I need to get a CFA Charter to become a successful Investment Banker?

-

CFA Myth 6: CFA is Male-Dominated

Is the world of Chartered Financial Analysts (CFA) exclusively dominated by men? Does it only cater to a particular gender? These are common misconceptions that need to be debunked. The realm of finance and the CFA program isn’t confined to one gender.

Dismantling Stereotypes: Women Thriving in the CFA Program

The misconception of a male-dominated CFA world needs to be shattered. Women are making significant strides, excelling in finance and the CFA program, proving their capabilities through remarkable achievements. Exceptional female CFAs have shattered stereotypes with their success stories and outstanding exam results.

Empowerment Through Opportunities: Support for Female Aspirants

Recognizing the importance of diversity, the finance industry and CFA institutes actively support aspiring female CFAs. Tailored scholarships and programs aim to empower aspiring female CFAs, promoting gender diversity.

Gender shouldn’t hinder your pursuit. The CFA program welcomes all passionate individuals regardless of gender, emphasizing skills and dedication over stereotypes.

In case you fail to clear your CFA exams, Proschool provides you with extra free classes & doubt solving sessions. Start your CFA Prep today!

-

CFA Myth 7: FRM Course is Easier

Misconceptions often arise when comparing different professional courses, and the belief that the Financial Risk Manager (FRM) course is easier than the Chartered Financial Analyst (CFA) program is one of them. Let’s unravel the facts and clarify the distinctions between the two courses.

Understanding the Distinction Between CFA and FRM

While the CFA program centers on investment management, the FRM course specializes in risk management. Both demand dedication and cater to distinct career paths within finance.

What’s the Right Course for Your Career Goals

Choosing between CFA and FRM is pivotal in shaping your finance career. Your career objectives, interests, and specific finance areas you’re passionate about are crucial factors to consider in making this decision.

Comparison: CFA vs FRM

| Aspect | FRM (Financial Risk Manager) | CFA (Chartered Financial Analyst) |

| Specialization | Focuses on financial risk management. | Offers a broad understanding of finance, including investment analysis, portfolio management, and more. |

| Career Focus | Ideal for those pursuing risk management careers. | Suited for roles in investment management, financial analysis, and various finance domains. |

| Substitutability | Cannot be substituted for CFA or vice versa in most cases. | Designed for candidates who are primarily interested in the respective areas of specialization. |

| Curriculum | Primarily covers risk assessment, market risk, credit risk, and operational risk. | Covers topics like ethics, economics, financial reporting, equity investments, and more. |

| Potential Employers | Financial institutions, banks, insurance companies, and risk management firms. | Diverse opportunities in investment firms, banks, asset management, and various finance-related sectors. |

Each program has its distinct focus and purpose, so make your choice based on your career aspirations and interests.

Also Read – Difference between CFA and FRM

Why CFA Will Dominate the Financial Industry in 2024

The financial world is changing, and in 2024, Chartered Financial Analysts (CFAs) are becoming more important. Let’s see why companies want them, what jobs they offer, and why their analysis skills matter.

Corporate Demand for CFA Professionals

As the financial sector becomes increasingly dynamic and complex, corporations are seeking professionals who can navigate this evolving terrain with expertise. CFAs are uniquely positioned to meet this demand for several reasons:

- Investment Analysis Expertise: CFAs offer deep insights in asset management, equity research, and portfolio strategy, aiding informed decision-making.

- Ethical Commitment: Adherence to ethical standards aligned with corporate values, fostering trust in the financial realm.

- Global Acumen: CFAs bring a global outlook, a valuable asset for corporations navigating international markets.

- Adaptability and Risk Management: Equipped with adaptable skills, CFAs adeptly handle dynamic financial landscapes and excel in risk analysis and management.

Expertise in Investment Analysis

Ethical Integrity

Global Perspective

Adaptability

Risk Management

CFA Career Opportunities and Analytical Skills

The financial industry’s evolving nature is creating diverse career opportunities, and CFAs are well-equipped to seize them:

- Investment Management: They’re good at managing money, which is important in today’s investment trends.

- Economic Research: They’re skilled at studying economics and making important decisions.

- ESG Investing: They care about ethical investing and can work in these areas.

- Fintech: They can work with technology and data in finance.

CFAs are great at solving complex money problems and making smart decisions. The CFA program helps them learn skills for the changing finance world in 2024.

In 2024, finance needs skilled professionals who can handle its challenges, adapt, and keep high ethical standards. The CFA program is perfect for this and stands strong in finance. If you’re into finance, think about the CFA program for a successful career.

Also Read – Top 9 Skills for a Financial Analyst To Reach Peak Potential

The Reality of CFA’s Prestige

The prestige of the CFA designation is rooted in its rigorous curriculum, ethical standards, and globally recognized certification. Professionals who earn the CFA charter are highly regarded for their expertise in investment management and ethical conduct.

Is CFA Worth it in India?

Thriving Finance Sector: India’s expanding finance industry in investments, stock markets, and wealth management makes a CFA designation advantageous.

- Higher Earning Potential: CFAs command competitive salaries due to their expertise in high-demand areas like investment management.

- Versatile Career Paths: With a comprehensive curriculum, the CFA offers flexibility across various finance fields, both in private and public sectors.

- Industry Relevance: Employers highly value CFA professionals for their specialized skills and adherence to high financial service standards, making the CFA designation sought after across sectors in India.

In India, the CFA Program has gained popularity, with over 10,000 professionals and a growing number each year. This surge reflects the increasing complexity of financial markets and the need for specialized financial knowledge in a competitive industry.

CFA Value in India

The CFA designation holds significant value in India’s dynamic financial landscape, offering unique advantages:

- Economic Growth: India’s thriving economy presents opportunities for CFAs to contribute their financial expertise. With a growth rate surpassing 7%, India is on track to become the world’s third-largest economy.

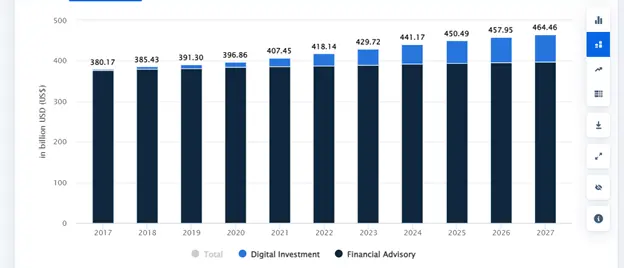

- Wealth Management: The rising number of high-net-worth individuals in India fuels the demand for wealth management services. CFAs skilled in investment management can find lucrative opportunities in this sector. The Assets under Management (AUM) are expected to reach around US$464.50 billion by 2027, showing steady growth.

Assets Under Management (AUM)

- Expanding Stock Markets: India’s BSE and NSE are gaining global recognition. CFAs find roles in equity research, portfolio management, and investment analysis within these markets. Investments surged by 18% compared to the previous month, marking a remarkable 127% increase from August 2022.

- Banking and Finance Growth: The banking sector saw a 31% increase in resource flow, with banks contributing 59%—a substantial rise from the previous fiscal year’s 46%.

- Regulatory Compliance: India’s financial sector demands strict compliance. CFAs, known for ethical conduct, are highly sought-after in this environment.

- Global Exposure: The CFA designation allows Indian professionals to compete globally, offering insights into international markets.

- Skill Diversification: The CFA curriculum covers diverse finance topics, providing career flexibility and adaptability in India’s financial sector.

- Ethical Foundation: CFAs uphold high ethical standards, a quality valued in India’s professional landscape.

The CFA designation holds immense value in India due to its economic growth and the demand for financial expertise across diverse finance sectors. For both MBA graduates and finance professionals in India, pursuing the CFA program can strategically propel their careers forward.

Also Read – 10 Reasons People Fail in the Exams of CFA® Program

Career Benefits, Salary Advancements, and Industry Niche

Embracing a career as a Chartered Financial Analyst (CFA) comes with significant financial benefits and avenues for career progression:

- Competitive Salaries: CFAs are highly valued in the finance industry, commanding competitive salaries due to their specialized expertise and ability to generate strong investment returns.

- Performance-Based Bonuses: Many firms offer CFAs performance-based bonuses, rewarding consistent exceptional performance and adding substantial income on top of their base salaries.

- Diverse Income Streams: CFAs can diversify their earnings by engaging in side projects like investment consulting, leveraging their deep financial market understanding for additional income.

- The CFA designation also opens doors for career growth:

- Leadership Roles: CFAs are considered for leadership positions for their adeptness in financial markets, risk management, and informed decision-making skills.

- Diverse Career Paths: CFAs have flexibility in career choices, spanning roles in investment banks, asset management, hedge funds, or launching their financial consulting ventures.

- Professional Network: CFAs gain access to a vast network of industry professionals through the CFA Institute, offering opportunities for mentorship, career advancement, and collaborative endeavors.

A CFA career not only brings financial rewards but also paves the way for extensive career growth.

The Attraction of CFA for MBA Graduates and Professionals with Master’s Degrees

The CFA program holds substantial appeal for MBA graduates and professionals with master’s degrees for several reasons:

Complementary Expertise: It offers specialized knowledge in investment analysis and portfolio management, complementing the broader finance education gained from their previous degrees.

Specialized Career Paths: The CFA charter unlocks opportunities in asset management, equity research, and risk analysis—roles demanding deep financial market insights.

Global Recognition: The CFA designation’s global reputation aligns with aspirations for international finance careers and demonstrates commitment to ethical standards.

Career Growth: It signifies dedication to mastering finance complexities, contributing to higher earning potential and leadership roles.

Pursuing the CFA program is a strategic choice for MBA graduates and professionals with master’s degrees. It complements their existing expertise, opens specialized career paths, offers global recognition, and facilitates career advancement, providing a competitive edge in the finance industry’s demanding job market.

How IMS ProSchool Prepares Students for CFA Success

IMS Proschool plays a pivotal role in preparing students for CFA success. With industry experts as instructors, practical training, and placement assistance, we equip students with the skills and knowledge required to excel in the challenging world of finance.

FAQs

- Is CFA suitable for someone with a non-finance background?

Absolutely. The CFA program is well-suited for individuals from non-finance backgrounds as it provides a comprehensive education in financial analysis and investment management. While it may require some additional effort to grasp certain financial concepts, it’s entirely possible to succeed in the program with dedication and a commitment to learning.

- Can an MBA in finance replace the need for a CFA certification?

An MBA in finance and a CFA certification serve different purposes. An MBA offers a broader business education, while a CFA focuses specifically on investment management and analysis. Depending on your career goals, you may choose to pursue either or both qualifications. Many professionals find that having both an MBA and a CFA enhances their career prospects and opportunities.

- Is the cost of the CFA program justified by the benefits it offers?

The cost of the CFA program is an investment in your career. The benefits it offers, including a competitive edge in the job market, career advancement opportunities, and specialized expertise in finance, often justify the expense. The return on investment can be substantial, especially considering the potential for higher salaries and leadership roles.

- Do I need to gain work experience only after passing the CFA exams?

To earn the CFA charter, you need to have completed four years of qualified work experience. However, this work experience can be accrued before, during, or after passing the CFA exams. Many candidates gain relevant experience while studying for the exams or in positions held before enrolling in the program. It’s essential to ensure that your work aligns with the CFA Institute’s guidelines for qualified experience.

Leave A Comment