The CFA Program has become one of the most pursued professional courses by Indian job aspirants in recent years. According to a survey, there are 20,000 CFA Charterholders in India, with the number growing every year.

India is indeed one of the largest markets for CFA Program candidate enrollment in the world. Candidates are choosing CFA over traditional B-School finance degrees, because the rigorous curricula and complexity of study of CFA have placed a premium on charter holders.

The rapidly changing landscape in business and industry globally, underpinned by the increasing complexity of the financial markets, has necessitated specialized knowledge and cutting-edge skills in Finance. And a CFA candidate has what it takes to rise up to the industry’s rigorous demands.

Let’s now take a look at the trending five CFA jobs in India.

Top 5 Trending CFA Jobs in India

-

Portfolio Manager

-

-

Role & Responsibilities

-

A Portfolio Manager is a finance industry expert who primarily works in the area of wealth creation, both for individual clients as well as corporate customers.

These professionals understand clients’ investment objectives, create strategic investment plans, and manage a bouquet of assets aimed at minimizing risk and maximizing returns. Portfolio Managers can either work individually or as part of a team when dealing with larger assets.

Contrary to popular perception, a Portfolio Manager is not an entry level job title. It is a coveted post, which requires hands-on work experience of about 10 years in Finance in a renowned organization.

Some of the tasks a Portfolio Manager takes up include:

- Manage the client’s financial assets, such as mutual funds, debt, stocks, etc.

- Create strategies that offer a good return on the investment

- Work with companies on tax returns or raising capital

- Analyze risk management and minimize any potential threats

- Make predictions based on market trends

-

Top Recruiters

-

- HDFC Mutual Fund

- Reliance Mutual Fund

- Franklin Templeton

- State Bank of India

- Goldman Sachs

- JP Morgan

-

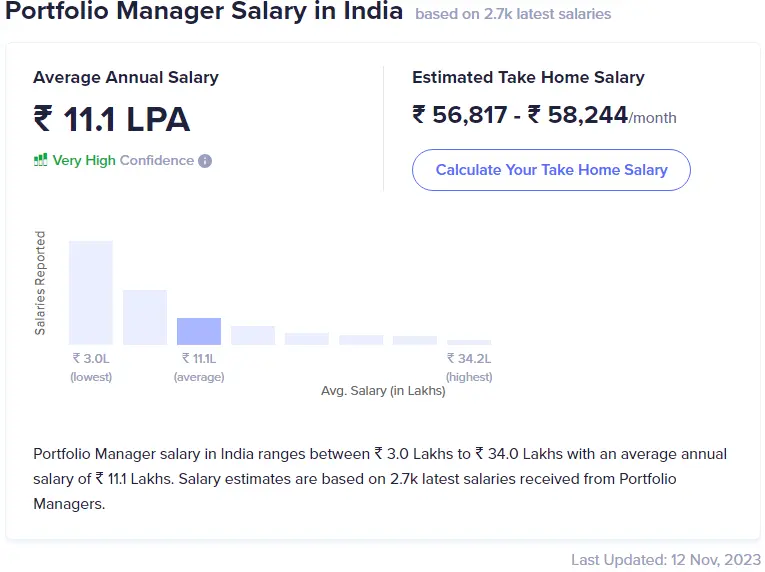

Salary Spectrum

-

₹ 3.0 Lac to ₹ 33 Lac with an average annual salary of ₹ 11.1 Lac.

Source – Ambitionbox

-

Investment Banker

-

Role & Responsibilities

-

An investment banker is a specialized financial professional providing a complete range of financial services to governments, investors, and businesses. They provide financial service solutions to get loans, raise stock capital, deal in stocks and bonds, negotiate mergers and acquisitions, manage investments and allocate resources. In addition, they act as the link between the investor and the company.

Some of the key roles of an Investment Banker include:

- Equity Financing

- Underwriting Deals

- Arranging Finances

- Dealing with M&As

-

Top Recruiters

-

- Goldman Sachs

- JPMorgan Chase & Co.

- Citi

- Accenture

- Credit Suisse

- HSBC

- TCS

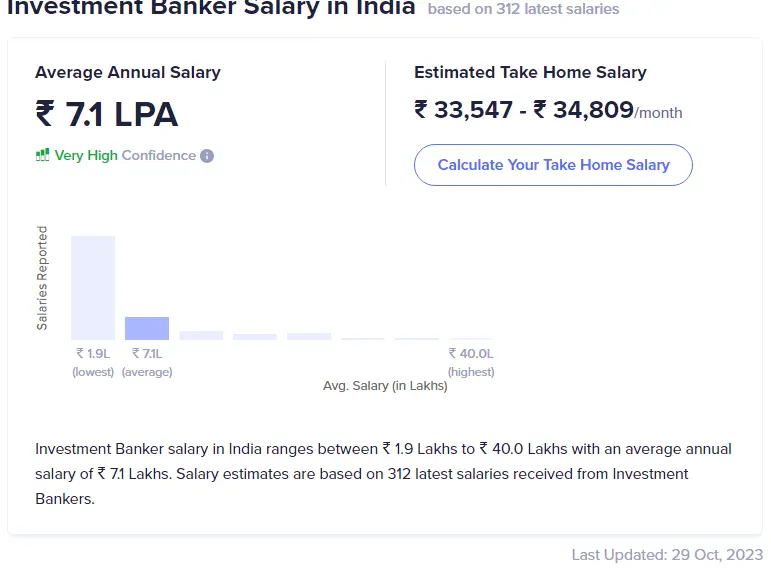

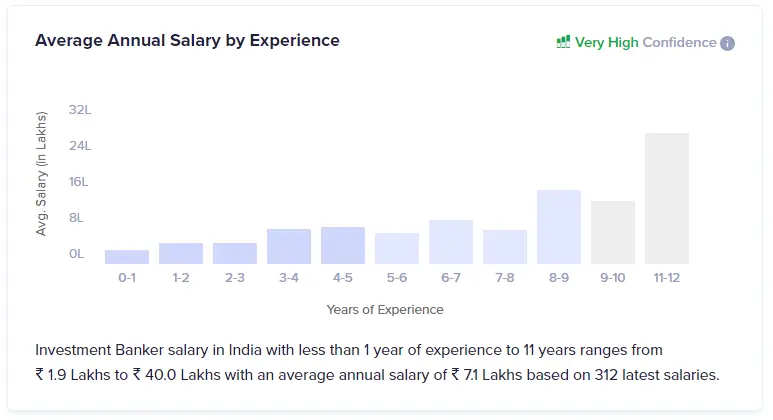

Salary Spectrum

Between ₹ 2.0 Lac to ₹ 40.0 Lac with an average annual salary of ₹ 7.1 Lac.

Source – Ambitionbox

-

Equity Research

-

Role & Responsibilities

-

Equity Research is the process of analyzing the company’s financial performance, ratio analysis, forecasting the financial statement in Excel, and conducting valuation for arriving at the intrinsic value of the share. Based on this valuation, the expert researchers recommend whether to “Buy”, “Sell” or “Hold” a stock.

The expertise of Equity Researchers is frequently sought by independent research houses, Knowledge Process Outsourcing companies (KPO), and Stock Brokerage firms.

Typically, an Equity Researcher is engaged in executing the following tasks:

- Generate Various Reports

- Do Financial Modeling

- Analyze data to identify emerging opportunities and risks

- Provide BUY/SELL/HOLD recommendations and present findings to the Investment Committee

-

Top Recruiters

-

- Morningstar

- CRISIL

- Deloitte

- FactSet

- Tata Consultancy Services

- J.P. Morgan

- S&P Global

-

Salary Spectrum

-

₹ 2.0 Lac to ₹ 22.0 Lac with an average annual salary of ₹ 9.9 Lac.

Source – Ambitionbox

-

Financial Analyst

-

Role & Responsibilities

-

A Financial Analyst tracks the financial situation of the company and keeps a pulse on the economic environment in general. They are responsible for the organization’s financial planning and analysis, allowing the business to make well-informed commercial decisions.

The everyday duties of a Financial Analyst include:

- Analyzing current and past financial data

- Looking at current financial performance and identifying trends

- Preparing reports on the above information and communicating the insights of these reports to the wider business

- Consulting with the management team to develop long-term commercial plans

- Suggesting budgets and improvements based on the above information

- Exploring different investment opportunities

- Developing financial models and providing financial forecasts

- Developing initiatives and policies that may improve financial growth

-

Top Recruiters

-

- Accenture

- Deloitte

- Amazon

- Wells Fargo

- Tata Consultancy Services

- EY

- Oracle

-

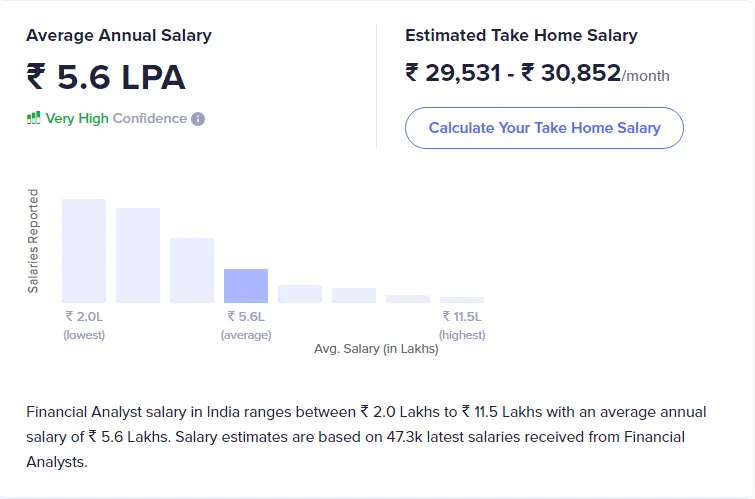

Salary Spectrum

-

₹ 2.0 Lac to ₹ 11.3 Lac with an average annual salary of ₹ 5.6 Lac.

Source – Ambitionbox

-

Relationship Manager

-

Role & Responsibilities

-

If you possess good communication skills, a keen understanding of financial products, and a CFA certification, you could work with a retail bank or an investment advisory firm.

Your responsibilities include:

- Maintaining good relationships with clients

- Addressing their concerns and questions about their financial details

- Creating strategies to preserve customer loyalty while increasing the client base

- Being knowledgeable about the latest financial products and services

-

Top Recruiters

-

- Morgan Stanley

- Goldman Sachs

- Wells Fargo

- HSBC

- Citi Group

-

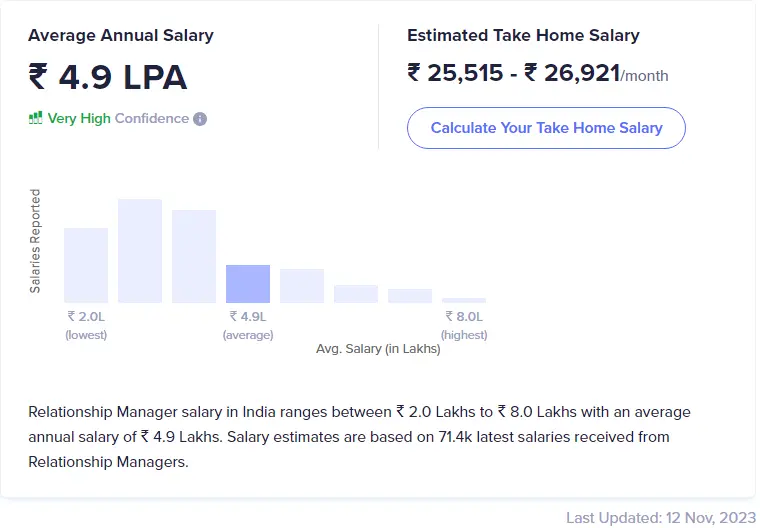

Salary Spectrum

-

Between ₹ 2.0 Lac to ₹ 7.9 Lac with an average annual salary of ₹ 4.9 Lac.

Source – Ambitionbox

The CFA Program – IMS Proschool’s Proven Course for Success

Proschool’s CFA Course is a highly recommended program, as it employs innovative teaching techniques and intensive skill learning methods to create world-class chartered financial analysts.

Here are the key highlights of our CFA Level 1 Course:

- CFA curriculum updated to March 2023 updates – Financial Modeling and Python Included in the training

- Get 250+ Hrs of training for CFA Level 1

- 5 Mock and 2000 Practice Questions

- Get jobs straight after Level 1

- Faculty are CFA charter holders

- Get customized study plan – Get a 6-month study plan which covers all 10 subjects and 3 months for revision.

- The batch starts every month

- Classroom training available in 10 cities

- Exam pass commitment – Proschool offers unlimited classroom and doubt-solving sessions in case you fail CFA Exams

- 84% of our students enrolling for CFA course recommend you join us

Leave A Comment