What is a Merger?

Mergers occur when two or more companies combine to form a single entity. A merger is defined as ‘transaction involving two or more companies in the exchange of securities and only one company survives’.

What is an Acquisition?

The acquisition is gaining control over the target company by either acquiring assets or gaining control over the board without physically combining the businesses.

Types of M&A?

Mergers based on the line of Business Activity

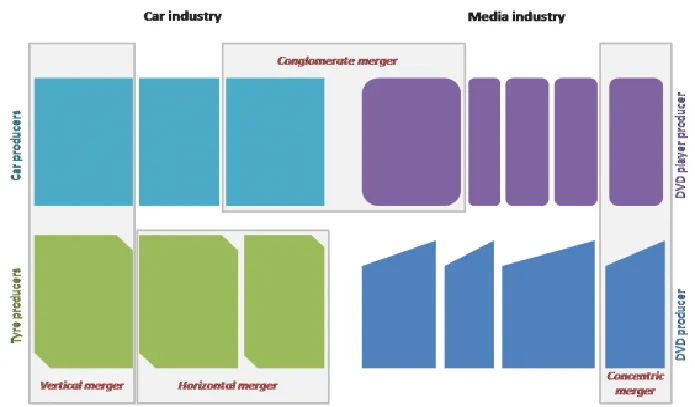

Horizontal Merger

A horizontal merger takes place when two or more companies with similar business or activity combine. This means that they have the same products and belong to the same sector. The synergy behind this type of merger is that the competition reduces and the acquiring company enjoys a larger market share and profits. In most of the cases, the company can also gain because of economies of scale. An interesting horizontal merger would be Pepsi and Coca Cola.

The merger of Cement Major ACC with Damodar Cements

ACC wanted to increase its existence in eastern India and hence merged with Damodar Cements a strong player in this region. The reason for this merger was to increase operating efficiency, productivity and to gain by achieving economies of scale. ACC additionally invested around INR 20 – 25 crore for expanding the capacity at Damodar Cements after the completion of the merger. This lead to an increase in the cement capacity of ACC from 4.3 million tonnes to more than 5 million tonnes.

Vertical Merger

A vertical merger means a company either merge backward with a company that provides raw material or forward in the direction of the consumers. Another type is balanced integration this is a mix of the forward and backward merger. The vertical merger brings companies together who are in a single line of business but at different stages. Vertical merger results in saving costs and an increase in profits margin since the middle cost is eliminated.

Carnegie Steel Company forward and backward merger

Carnegie Steel Company dominated the steel market by using vertical integration. It not only bought the steel mines but also took over the railroads and strengthened the distribution channel. This allowed the company to cut prices and produce cheaper steel.

Conglomerate Merger

Conglomerate merger is when two companies with a completely different set of activities or services come together. One important advantage of the conglomerate merger is that it helps the companies in gaining diversification benefits. Customer base can be increased and economies of scale can be achieved. This will also help in the utilization of excess cash and human resources.

Mohta Steel Industries merger with Vardhaman Spinning Mills Limited

This is a classic case of a merger between two extremely unrelated sectors Steel industry and Spinning mills. Samsung, Google, Honeywell are other major companies which have set diverse business by conglomerate merger.

Mergers based on a line of Controlling Interest

When the acquiring company captures the target company by will and with mutual consent; it is considered a Friendly merger. The friendly merger has many benefits for the target company especially the pricing. The price offered is almost always higher than the price in the market.

One of the most popular examples of a friendly takeover of Whatsapp by Facebook for $19 billion. Acquisition of Ranbaxy by Daiichi Sankyo is another popular example.

On the other hand, a Hostile takeover happens when the acquiring company takes over the target company against the wish of the management. Hostile mergers take place in the form of tender offer where the shareholders of the target company or engage in a proxy fight to replace the current management. A variety of strategies are carried out for a hostile takeover.

The takeover of Shaw Wallace, Dunlop, Mather & Platt and Hindustan Dorr Oliver by Chhabrias and the takeover of Ashok Leyland by Hindujas are examples of hostile M&A are the classic cases of hostile takeovers.

A bailout takeover is when a financially stable company or government organization takes over a weak company to regain its strength. The main goal of this kind of operations is to help the weak company to regain its financial strength without liquidating its assets

Mergers based on Strategic Transactions

Strategic M&A is done essentially to gain synergies. Two different entities are more profitable when combined.

A financial merger happens when the shareholders the bidder believes that the price of his stock is less than the value of its assets.

The below statement is an example of both Strategic and Financial merger –

Reverse M&A is when a small company acquires a larger company. The merger of ICICI with its arm ICICI bank is a sample of a reverse merger between parents and companies. They retained the name of ICICI bank for its new company.

Downstream M&A is when a parent company acquires its subsidiary while the upstream merger is when a subsidiary mergers with its parent company. Defacto M&A is a legal form of the merger but only assets are acquired. Cash M&A is when shareholders get cash for their shares while some shareholders get shares of the surviving company. Short term M&A is when the parent company acquires all the voting rights in the subsidiary.

Conclusion

Hope this article helped you to understand the different types of mergers. Every merger will have different motives and synergies. An additional thing to note is that mergers will not always be successful there are key strategies, valuation methods and financial decisions that are required to work out before taking any step. Read more: Everything you need to know about Managerial Finance

Leave A Comment