2000+ Aspirants Successfully

Trained

Winner of CIMA platinum award in India

Record breaking

80%+ passing

Rate

CGMA qualification for CXO roles

Institute with

100+ CIMA

Charterholders

About The Course

CIMA is the world’s leading professional body of Management Accountants. Management Accountants analyze financial information from management perspective (as opposed to compliance perspective e.g. in audit etc) to improve business performance. In that sense, it is a business management function.

CIMA provides CGMA designation, which is jointly offered by CIMA and CPA (USA). The qualification is especially popular with European employers. As per CIMA, its students are working with 96% of FTSE top 100 companies.

Where Our Alumni Work

Our Alumni are all placed in reputed firms in high positions due to the knowledge and skill gained from this course

Meet Course Tutors

Why Us

Our aim is to focus on personal career goals and give our best to the students.

Dedicated CIMA Partner

IMS Proschool has been awarded Best Learning Partner of the year by CIMA India. More than 100 students from IMS Proschool have become CIMA Charterholders.

Practical Knowledge

Our mentors are experienced professionals, who have been working in the industry for a long time and know a lot about its working. They’ll be passing on this valuable knowledge and make you job-ready.

Expert Faculty

Our faculty members of industry experts and experienced professionals deliver exceptional experiential training and mentorship.

Immense Training Experience

Proschool has trained more than 20,000 employees of different financial organizations on Financial Analysis, Wealth Management, Financial Planning, Equity Research, Management Accounting etc.

High-Quality Resource Material

We provide recorded lectures and notes by our experts to all our students. They are great for revisions and revisiting from time to time.

Valuable Placement Assistance

We offer customized jobs based on your work preferences. You can also get profile development help in the form of resume creation, mock interview preparation, soft skills, and much more.

Certifications

CFA charter – You become a charterholder after you successfully clear the CFA level 3 exam and complete four years of relevant work experience.

Chartered financial analyst®:

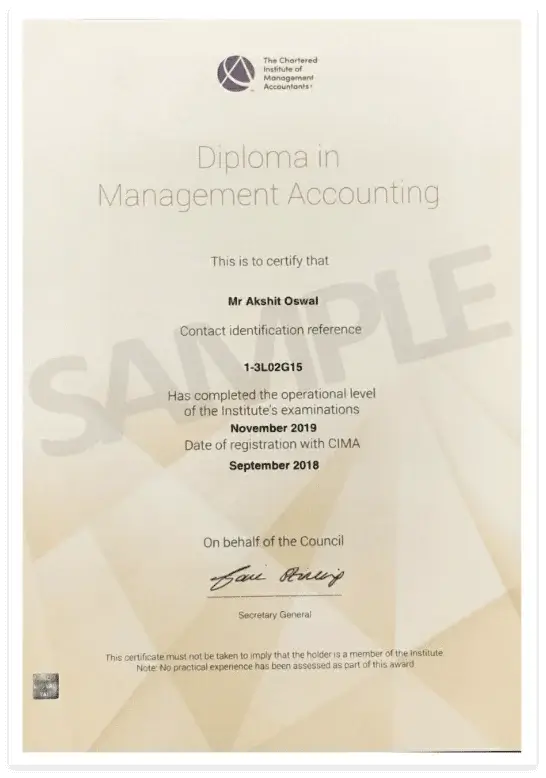

Diploma in Management Accounting (Dip MA) from CIMA, UK after passing the OCS Exam.

Adv Dip from CIMA UK

Advanced Diploma in Management Accounting (Adv Dip MA) from CIMA, UK after passing the MCS Exam.

ACMA / CGMA from CIMA UK

ACMA, CGMA from CIMA, UK after passing SCS Exam & fulfilling PER requirements.

GMA certificate from IMS Proschool

Students will also receive a completion certificate from IMS Proschool on successfully passing the GMA course. A certificate in Financial Modeling from IMS Proschool

GMA certificate from IMS Proschool

Students will need to clear 2 Exams conducted by IMS Proschool to receive a PG Certification. These are case study exams conducted at the end of Term 1 and Term 2 of the program.

About Certifying Authorities

About CIMA

CIMA (Chartered institute of Management Accountants) established in the year 1919, is a globally recognized qualification for careers in Business & Finance. CIMA is the world’s largest professional body of Management Accountants with more than 250,000 members working in around 180 countries. In collaboration with the CPA (USA) institute, CIMA members receive an additional designation- CGMA. CIMA has more than 4500 training and recruitment partners across the globe.

About IMS Proschool

IMS Proschool as an extension of the IMS Brand focuses on developing a sustainable career for its student communities by training, motivating and guiding its students to gain success. Its association with CIMA, NSDC and Association of Chartered Accountants further enhances its services.

This is what our students say about us.

Program Highlights

Here are the major features of CIMA Course.

Eligibility

Anyone who is undergoing graduation or is a graduate in any discipline can join the CIMA course.

FAQ’s

Need More Info? Read Our Latest Blogs

Explore, Share And Enjoy Our Curated Content

How would you like to work with big multinational corporations, global consulting firms or international banks? Does being a key player in the decision-making process [...]

It is a nice time to be a management accountant in India. The current corporate climate has created a demand for globally qualified professionals to [...]

Heading into a finance or accounting career means making choices, especially when it comes to certifications like CIMA and CFA. Both certifications indicate strong financial [...]