Are you considering a career in finance but feeling overwhelmed by the many options available? Choosing the right career path can be daunting, especially in the dynamic and ever-evolving field of finance. That’s why we’ve put together this blog post to highlight the 5 most trending career profiles in finance.

Selecting the right career in finance is crucial, as it can significantly impact your professional growth and financial success. With the right skills, knowledge, and qualifications, you can build a rewarding career in finance that offers numerous opportunities for advancement and personal fulfilment.

In this article, we’ll explore the best finance jobs in India and highlight the key responsibilities, qualifications, and skills required for each role. So, whether you’re just starting in your career or looking to make a switch, this article will provide valuable insights into some of the most in-demand and lucrative careers in finance.

So, if you’re ready to take the next step in your finance career, keep reading to discover the top finance jobs trending in India today.

Top 5 Trending Career Profiles in Finance

Are you considering a career in finance and wondering which job profiles are currently trending in the industry? We have listed the top five finance job profiles in India gaining popularity. These job profiles not only offer a promising career path and lucrative salary packages. So, let’s explore the trending finance career profiles in India.

1. Fintech Professional:

Fintech professionals are in high demand due to the rapid growth of the fintech industry, which includes using technology to improve financial services and make them more accessible to customers. They also work on improving existing financial services, such as banking and insurance, by integrating technology to make them more efficient and user-friendly. Fintech professionals work in a variety of roles, such as software development, product management, and data analytics.

Some prominent Indian individuals working in this role are:

- Kunal Shah, founder of CRED

- Harshil Mathur, founder of Razorpay

Companies that hire Fintech Professional in India:

- Paytm

- PhonePe

- Razorpay

How to get into the role of a Fintech Professional?

To become a Fintech Professional in India, you need to have a strong foundation in computer science and programming as well as a good understanding of finance and financial markets. Gaining experience in the field by working in a financial services or technology company and networking with professionals in the industry are also important steps. Keeping yourself updated with the latest trends and developments in the industry through industry publications, webinars, and pursuing short term financial courses by premier institutes like IMS Proschool is also crucial and can give you an extra edge in your career growth.

Start your career as a Fintech Professional

2. Financial Analyst:

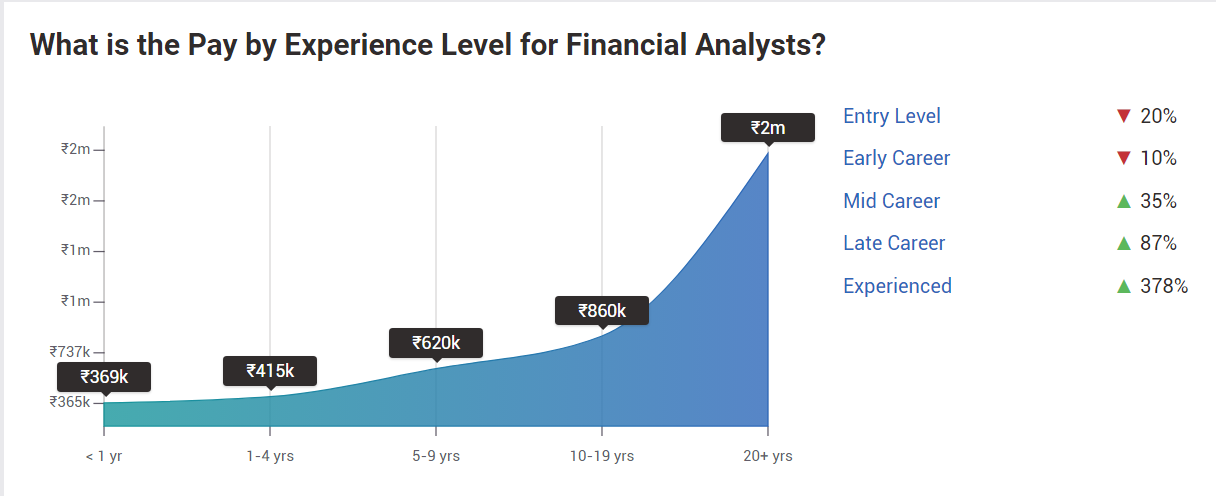

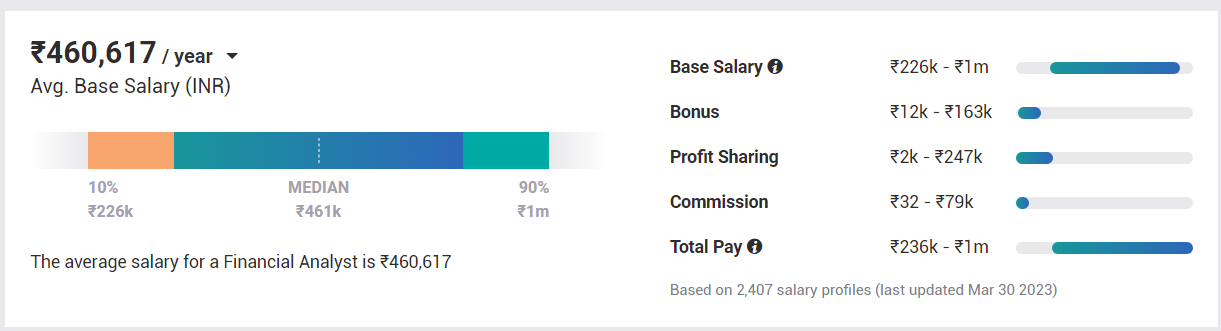

Financial Analysts are responsible for analyzing financial data and providing insights to aid decision-making. They work in various sectors, such as investment banking, private equity, corporate finance, and more. The role of a financial analyst requires a strong analytical mindset and excellent communication skills. According to Payscale, the average salary of a financial analyst in India is around ₹5,00,000 per annum.

Some prominent Indian individuals working in this role are:

- Aakash Goyal, Financial Analyst at Goldman Sachs

- Sneha Ramakrishnan, Financial Analyst at Morgan Stanley

Source: Payscale

Companies that hire Financial Analysts in India:

- Goldman Sachs

- Morgan Stanley

- JPMorgan Chase

- Citibank

How to get into the role of a Financial Analyst?

To become a financial analyst, one can pursue a CFA (Chartered Financial Analyst) course or a finance, accounting, or economics degree. Also, while choosing the right institution to prepare for the CFA exam, ensure that teaching faculty are CFA charter holders. This way, you can get many insights and learn from their experience. Opt for institutions that provide customized study plans as per your calibre and requirements. And if they provide exam pass commitment, nothing like it.

Did you know, IMS Proschool provides Exam pass commitment to all its CFA students

It is often difficult to find institutions that package all such benefits into one course, but you are lucky! IMS Proschool offers not just this but many more perks to students enrolling in their CFA Level 1 program. You can click here to visit their website and explore the amazing benefits of pursuing financial courses from this platform.

Skills Required to Become a Financial Analyst:

- Strong analytical and problem-solving skills

- Proficiency in financial modeling and forecasting

- Knowledge of accounting principles and financial statement analysis

- Familiarity with financial software and databases

- Excellent communication and presentation skills

- Attention to detail and accuracy

- Ability to work under pressure and meet tight deadlines

- Strong work ethic and willingness to learn and adapt to new technologies and tools

- Understanding of economic and industry trends

- Teamwork and collaboration skills to work effectively with other stakeholders in the organization.

Job Duties and Responsibilities of a Financial Analyst:

The job duties and responsibilities of a financial analyst can vary depending on the industry they work in. However, some common responsibilities include:

- Analyzing financial data and economic trends to identify investment opportunities

- Creating financial models to evaluate investment options

- Preparing reports and presentations to provide recommendations to clients

- Collaborating with team members to research and analyze financial data

- Monitoring financial performance and assessing risks associated with investments

Overall, financial analysts play a crucial role in the financial industry by helping individuals and businesses make informed investment decisions. They must possess strong analytical, problem-solving, and communication skills to succeed in this career.

Read – How to build a career in finance industry

3. Investment Banker:

Investment bankers advise clients on financial transactions such as mergers and acquisitions, IPOs, and other fundraising activities. They work in investment banks, private equity firms, and venture capital firms. The role of an investment banker requires a combination of analytical skills, financial modeling expertise, and business acumen. The average salary of an investment banker in India is around ₹9,00,000 per annum.

Some prominent Indian individuals working in this role are:

- Vishal Soni, Director of Investment Banking at Credit Suisse

- Aarti Shah, Director of Investment Banking at Deutsche Bank

Companies that hire Investment Bankers in India:

- Goldman Sachs

- Morgan Stanley

- Credit Suisse

- Deutsche Bank

How to get into the role of an Investment Banker?

One can pursue an MBA in finance or a degree in economics or business to become an investment banker. Alternatively, suppose you don’t have the bandwidth to spend so much time or money pursuing a full time MBA. In that case, you can also consider mini MBA or short term professional courses in finance offered by premium institutions like IMS Proschool that come with placement support and job opportunities.

Skills Required to Become an Investment Banker

- Strong analytical skills: Investment bankers must be able to analyze complex financial data and make informed decisions based on that data.

- Excellent communication skills: Investment bankers must be able to communicate effectively with clients, colleagues, and other stakeholders.

- Strategic thinking: Investment bankers must be able to think strategically and develop creative solutions to complex financial problems.

- Attention to detail: Investment bankers must have a keen eye for detail and be able to spot errors or inconsistencies in financial data.

- Financial modeling skills: Investment bankers must be skilled in financial modeling and understand valuation techniques.

Did you know, you could easily earn an AICTE Approved PG Certificate in Investment Banking with IMS Proschool

Job Duties and Responsibilities of an Investment Banker

- Financial analysis: Investment bankers conduct financial analysis to evaluate the financial performance of companies and identify potential investment opportunities.

- Deal structuring: Investment bankers help structure deals, such as mergers and acquisitions, to ensure that they are financially viable and meet the needs of all parties involved.

- Due diligence: Investment bankers conduct due diligence to identify potential risks and liabilities associated with a particular investment.

- Client relationship management: Investment bankers build and maintain relationships with clients and advise them on financial matters.

- Pitching and presentations: Investment bankers create presentations and pitch ideas to potential clients to win business.

Investment bankers typically work long hours and are under high pressure to meet deadlines and close deals. However, the rewards for those who succeed can be significant, with salaries and bonuses among the highest in the finance industry.

If you’re interested in pursuing a career as an investment banker, you will need a strong educational background, typically with a degree in finance, economics, or business. Many investment bankers also hold advanced degrees, such as an MBA. Building a strong network and gaining relevant experience through internships or entry-level positions can also help secure a job in this competitive field.

4. Financial Planner:

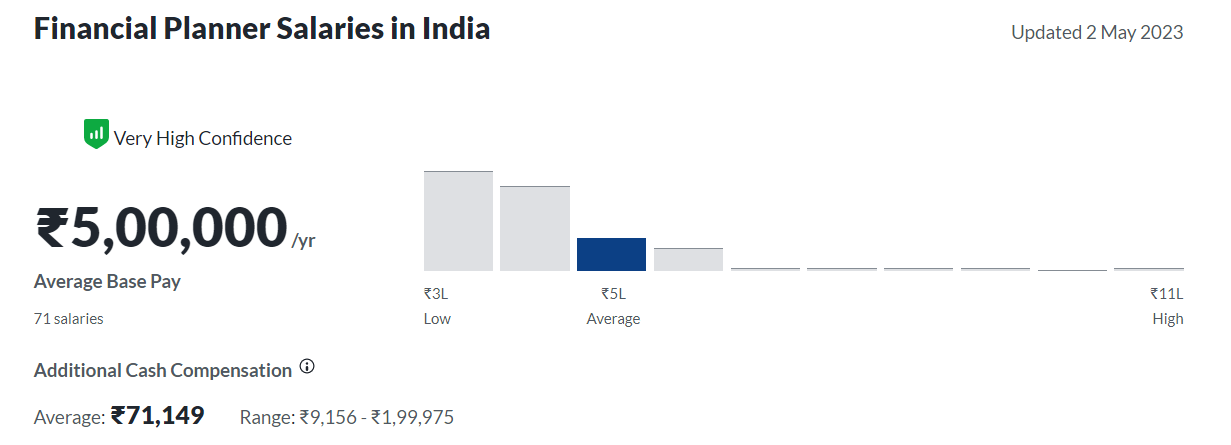

Financial Planners help individuals and businesses manage their finances, investments, and retirement planning. They work in financial advisory firms, banks, and insurance companies. The role of a financial planner requires a combination of financial knowledge, interpersonal skills, and business acumen. According to Glassdoor, the average salary of a financial planner in India is around ₹5,00,000 per annum.

Some prominent Indian individuals working in this role are:

- Suresh Sadagopan, Founder of Ladder7 Financial Advisories

- Manoj Nagpal, Founder of Outlook Asia Capital

Source: Glassdoor

Companies that hire Financial Planners in India:

- HDFC Bank

- ICICI Bank

- Axis Bank

- Kotak Mahindra Bank

How to get into the role of a Financial Planner?

One can pursue a CFP (Certified Financial Planner) certification or a degree in finance or accounting to get into the role of a financial planner. You can also consider courses in financial modeling which comes with NSE Certification and Additional Certification In Equity Research & M&A. The benefit of opting for such courses is that it opens up your career pathway in other finance related roles.

Skills Required to Become a Financial Planner:

- Financial Knowledge: A financial planner should have a strong foundation in financial concepts like taxes, investments, retirement planning, estate planning, and insurance.

- Analytical Skills: Financial planners need to be analytical and have the ability to analyze financial data and create financial plans based on the analysis.

- Interpersonal Skills: Since financial planners deal with people daily, they should have excellent communication skills and the ability to build strong relationships with clients.

- Business Acumen: Financial planners should have a good understanding of the business world and be able to interpret financial statements and make sound financial decisions.

- Problem Solving Skills: Financial planners should have strong problem-solving skills to help clients resolve complex financial issues.

Job Duties and Responsibilities of a Financial Planner:

- Assessing Clients’ Financial Needs: Financial planners meet with clients to understand their financial goals and needs and create a customized financial plan based on their financial situation.

- Creating Financial Plans: Once the client’s financial situation is assessed, the financial planner creates a financial plan that meets the client’s financial goals.

- Managing Investments: Financial planners help clients manage their investments by choosing appropriate investment strategies and monitoring their portfolios.

- Retirement Planning: Financial planners help clients plan for retirement by creating a retirement savings plan and advising clients on maximising their retirement benefits.

- Insurance Planning: Financial planners help clients select appropriate insurance policies to protect their assets and manage risk.

5. Risk Manager:

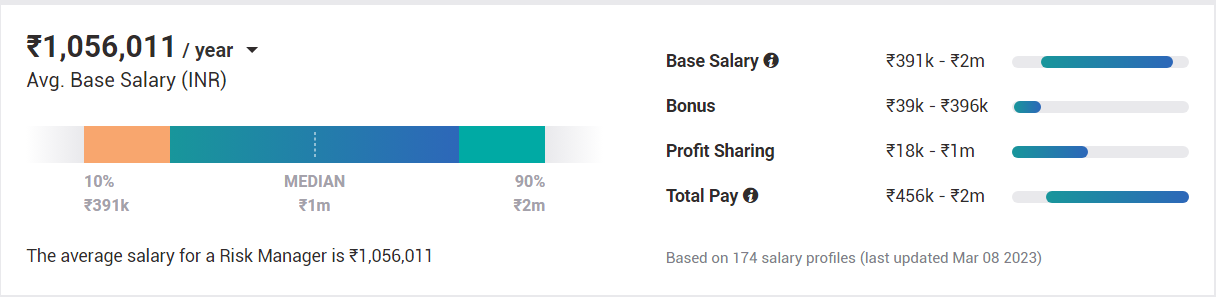

Risk Managers identify and assess potential risks that can impact the financial health of an organization. They work in banks, insurance companies, and other financial institutions. The role of a risk manager requires a combination of analytical skills, risk management expertise, and knowledge of regulatory compliance. According to Payscale, the average salary of a risk manager in India is around ₹11,00,000 per annum.

Some prominent Indian individuals working in this role are:

- Arpinder Singh, India Head of Fraud Investigation & Dispute Services at EY

- Mayank Bathwal, CEO of Aditya Birla Health Insurance.

Source: Payscale

Source: Payscale

Companies that hire Risk Managers in India:

- HDFC Bank

- ICICI Bank

- Axis Bank

- Kotak Mahindra Bank

How to get into the role of a Risk Manager?

One can pursue a risk management, finance, or business administration degree to become a risk manager. Additionally, obtaining certifications such as FRM (Financial Risk Manager) or PRM (Professional Risk Manager) can also be beneficial. You can also consider similar courses offered by IMS Proschool, which come with placement support and other benefits.

Skills required to become a Risk Manager:

- Analytical Skills: Risk managers need to analyze data and make informed decisions based on the results to identify potential risks and develop strategies to mitigate them.

- Financial Acumen: A strong understanding of finance, economics, and accounting principles is essential to analyze financial data, evaluate risks, and make strategic decisions.

- Communication Skills: Risk managers need to effectively communicate complex information to stakeholders and employees and provide recommendations for risk management strategies.

- Attention to Detail: Risk managers must have a keen eye for detail to identify potential risks and develop strategies to mitigate them.

- Leadership Skills: Risk managers must be able to lead a team and work collaboratively with other departments to implement risk management strategies.

Job Duties and Responsibilities of a Risk Manager:

- Identify and assess potential risks that could impact the organization’s financial performance.

- Develop and implement risk management strategies to mitigate identified risks.

- Monitor and evaluate risk management strategies to ensure their effectiveness.

- Provide reports and recommendations to senior management on potential risks and their impact on the organization.

- Ensure compliance with regulatory requirements related to risk management.

Bonus Profile – Actuary:

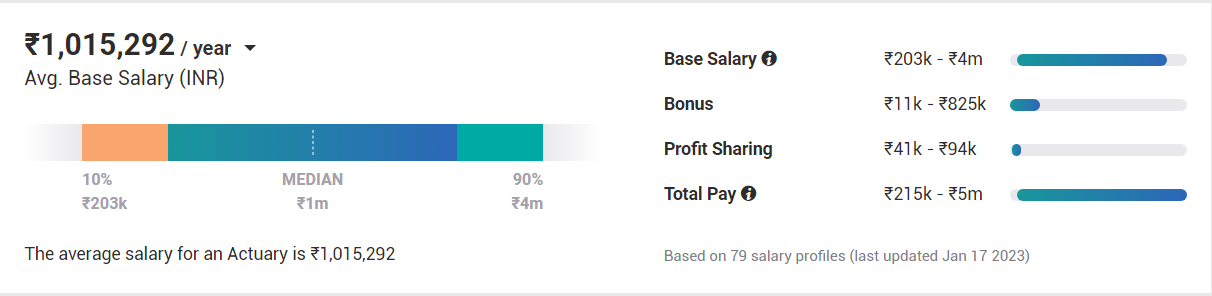

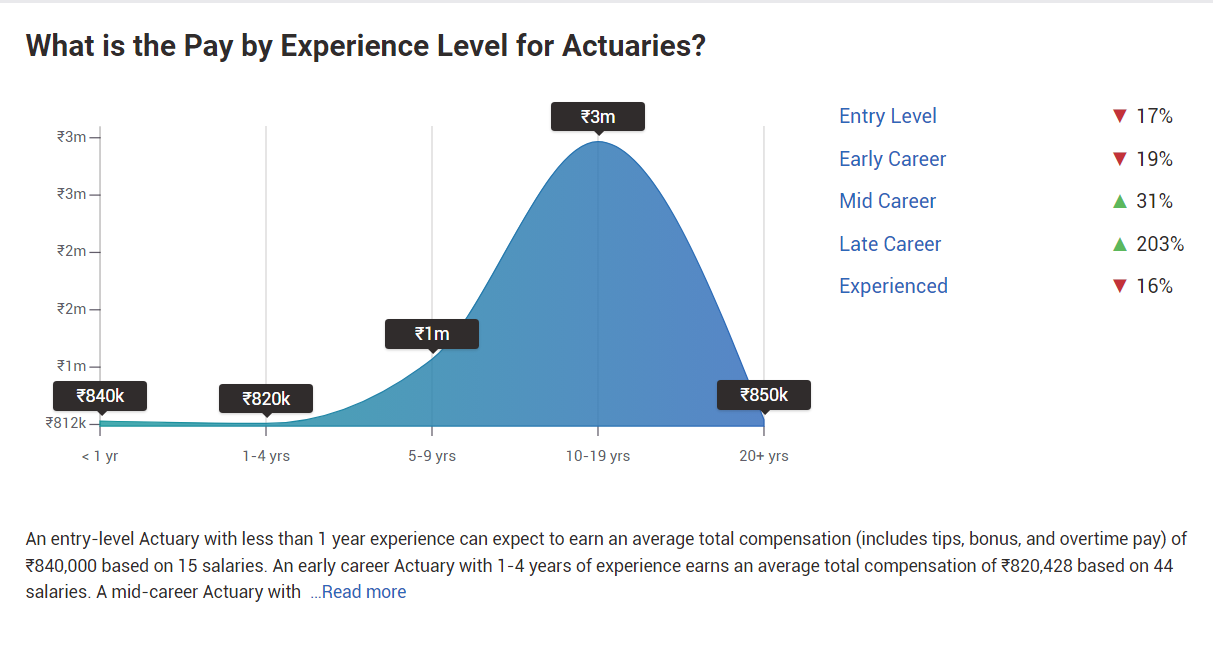

Actuaries use their mathematics, statistics, and finance skills to analyze the financial impact of risks and uncertainties. They work in various industries like insurance, finance, and government agencies. The role of an actuary requires a high degree of analytical skills, attention to detail, and the ability to communicate complex financial concepts to others. According to Payscale, in India, the average salary of an actuary is around ₹9,00,000 per annum.

Some prominent Indian individuals working in this role are:

- Sunil Sharma, President and Chief Actuary of Kotak Life Insurance

- Prabhat Diksit, Chief Actuary of SBI Life Insurance.

Source: Payscale

Companies that hire Actuaries in India:

- Aon India

- Bharti AXA Life Insurance

- Bajaj Allianz Life Insurance

- HDFC Life Insurance

- ICICI Prudential Life Insurance

How to get into the role of an Actuary?

To become an actuary, one can pursue an actuarial science, mathematics, or statistics degree. Additionally, obtaining certification from professional organizations such as the Institute of Actuaries of India can be beneficial. If you plan to pursue an alternative way of landing a job in actuaries, try considering a course in financial modeling by Proschool, where you can learn 6 financial modeling techniques and start your career in actuary soon.

Actuaries are among the most highly paid and in-demand professionals in the finance industry. They work in various sectors, including insurance companies, banks, investment firms, and government agencies. Actuaries analyze data using statistical and mathematical models to forecast financial outcomes and help organizations make informed decisions.

Skills required to become an Actuary:

- Strong mathematical and statistical skills

- Analytical and problem-solving abilities

- Attention to detail and accuracy

- Excellent communication and interpersonal skills

- Business acumen and strategic thinking

- Proficiency in computer programming and data analysis

Read – A Brief on Actuary Jobs: Roles & Responsibilities & Career Opportunities

Job duties and responsibilities of an Actuary:

- Analyzing data and financial information to calculate the likelihood and potential cost of future events

- Developing and implementing financial strategies to manage risks for businesses and organizations

- Designing and pricing insurance policies and retirement plans

- Providing guidance and recommendations to management on financial decisions and risk management strategies

- Communicating complex financial concepts to non-technical stakeholders

- Staying up-to-date with industry regulations and trends

- Collaborating with other professionals such as accountants, financial analysts, and underwriters

Overall, an Actuary plays a critical role in helping businesses and organizations make informed financial decisions and manage risks effectively. To succeed in this career, individuals must possess strong mathematical and analytical skills and excellent communication and strategic thinking abilities.

As we reach the end of this article, let’s briefly summarize the key takeaways from it.

Conclusion

Choosing the right career in finance is essential for a successful and fulfilling career. Identifying your strengths and interests is crucial to find the right job that aligns with your career goals. With the finance industry growing rapidly, there are numerous opportunities for individuals with the right skill set and expertise.

For readers who want to learn more about the best finance jobs in India, look for courses or certifications that help you develop multiple skills under expert guidance. So that if you ever feel that a particular role is not suitable for you, you have other options open for yourself. One can explore job portals such as Naukri.com, LinkedIn, and Glassdoor to search for job opportunities and learn about the skills required for different roles. Additionally, networking with professionals in the industry and attending finance-related events can provide valuable insights and help you make informed career decisions.

Overall, the finance industry offers exciting career opportunities for individuals who are passionate about finance and have the necessary skills and expertise. By identifying your strengths and interests and exploring different career paths, you can find the best finance job in India that aligns with your career goals and offers a fulfilling career.

Leave A Comment