Top 9 Skills for a Financial Analyst To Reach Peak Potential

Here's What We've Covered!

We can’t begin to state the importance of analytical skills in a financial analyst’s life. That being said, in today’s world employers are looking for many other attributes in an ideal Financial Analyst. So, here are nine of the most important skills that are must-haves in today’s world.

PS: keep a mental note of the number of skills you currently possess.

RESEARCH SKILL

Hey, Financial Analyst! Meet your new best friend: Research. No jokes, research iss the most important part of an Analyst’s day to day job. This is because unless the correct data is mined by using proper research skills, there will be no scope for analysis. This skill requires 1. Precise understanding of the problem/scenario, 2. Listing down all the required questions and 3. Finding their answers out. As such, one has to be alert and resourceful to have good research skills. To arrive at a solution for the client’s financial profiles, the analysts have to put their researching hats on, compile details and come up with an approach to reach the solution.

Let me introduce you to my friend Priya, who is a financial analyst. Priya wants to calculate the valuation of a private company for her client. She uses her research skills to identify public companies across the globe that would match the sector her company operates. After identifying their peers, she then tries to gain more insights into their business model and the growth rate of the country in which they operate. She then assigns proper weightage to all the peers and comes down to a valuation number that seems fairly correct. Full marks to Priya!

ANALYTICAL SKILLS

When we say Analytical skills, we mean the demonstration of logical thinking, gathering of data and looking at them in different possible ways. However, analytical skills can’t really be learned by reading books, but have to be acquired through experience and a solid foundation. Analysts are expected to be good with databases and excel. These tools help in analyzing the data, comparing data and making helpful visual presentations for the clients. Pivot tables, different types of graphs and excel formulas can all be used to analyze the data.

For instance, my friend Priya looks at a number of companies at once and compares their results. As such, it is quintessential that she is able to use an excel formula to calculate in one go rather than doing it manually. Further, she also uses another fascinating feature of MS excel, the pivot table, to segregate and present data in a simple and convenient manner.

Considering a career switch from Engineering to Investment Banking? Here’s how you can do it perfectly.

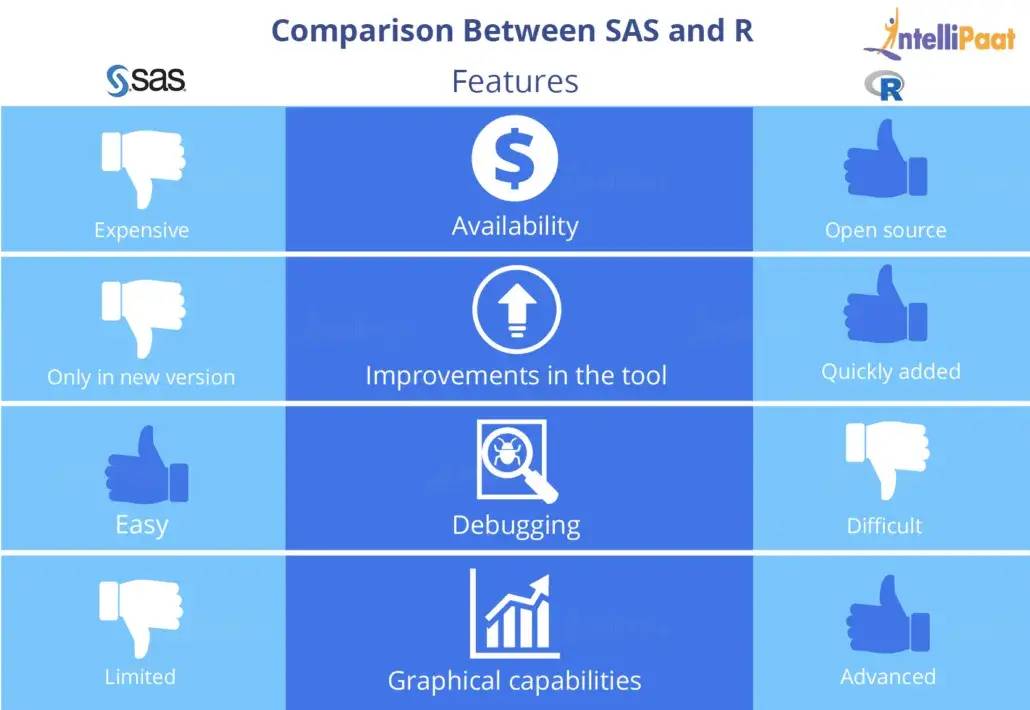

TECHNICAL SKILLS

For a financial analyst, technical skills are becoming increasingly necessary. Firms today are looking for candidates who have a strong knowledge of languages like SQL, Python, SAS, R, etc. Knowing these languages helps in managing a large amount of data with ease. Further, proficiency in MS Excel and MS PowerPoint is a must. This not only helps you in managing data but also in navigating company databases and other software applications.

Nowadays, companies use MS Excel for valuing equities, and other customized analytical tools for complex securities such as credit default swaps and other fixed-income instruments. Carrying out such complex calculations via excel would be a tall task as they involve large amounts of data.

COMMUNICATION SKILLS

Good written and oral skills, and explaining complex financial jargons in simple words are crucial skills for a Financial Analyst. In fact, analysts also who represent their firms, have to be confident in their speaking and writing skills. These skills are also important because, at times, you have to literally wean information out from your client efficiently and effectively.

Coming back to our friend Priya. After all her efforts, she now has to present her findings to her clients. She confidently presented her findings by providing a well-written document that clearly stated her approach. The client also appreciated her work and approved her report. Priya has strong communication and writing skills that support her research skill which resulted in a very smooth and excellent presentation. Priya is super smart, be like Priya.

Read more: 8 SIMPLE TECHNIQUES ON IMPROVING COMMUNICATION SKILLS AT WORK

MATHEMATICAL SKILLS

The job of a financial analyst is mainly focused on number-crunching; however, the level of complexity depends on the type of job. Hence, you should not be intimated by numbers. For example, analysts in the equity research department need to have great mathematical skills as they have to value companies using various methods like DCF, market comparables, etc. In fact, there are financial analysts known as fixed-income analysts, who deal with valuing complex asset classes like credit default swaps (CDS) that involve complex formulas and maths. Valuing options and forwards are known as ‘quant’ jobs which are even more complex.

Fancy a career in the capital markets? Here’s everything you need to get started.

LEADERSHIP SKILLS

An analyst will eventually need to take up responsibility as a lead for a team of analysts, and this requires leadership skills. It is not just about leading a team, but also mentoring junior analysts and creating a friendly and collaborative atmosphere that will build successful teams. Even as an entry-level analyst, you must acquire and display skills of leadership. This is because project management and effective communication is required at every step of the job. And, to build a culture of teamwork you must possess strong leadership skills. If you are self-driven and are able to ignite motivation in others, there will be no boundaries to your success. And, it goes without saying that leadership experience in the CV will give you an edge without a doubt.

Think you have the right leadership skills to pursue a career in capital markets and investment banking? Then you must check out this PG program.

DECISION MAKING

The finance industry is ever-evolving, which for a financial analyst translates to keeping up with the pace. You must be able to make sound decisions on the spot to keep your client ahead, always. The ability to tackle complex problems is a must-have. Decision-making skills here may include finding the right companies for a merger, understanding the nitty-gritties of a complex business model, figuring out a tax dilemma, etc. Having a track record of making good decisions can help your career grow at a faster pace. Employers rely on candidates who can pull off wonders in difficult times. A top candidate takes action and finds the right solution regardless of how bad the situation is.

For instance, Priya was asked by a client to help their company out of a tax dilemma. She was asked to provide an update within a few hours. Priya realized that it would take her way too long if she undertook the task all by herself. She decided to quickly take out similar cases from the past and then consulted a senior tax specialist in her organization. Within a few hours, there she was with a solution for her client. Priya’s quick thinking and decision making skills helped her in providing the expected results to her client, that too within the deadline.

ATTENTION TO DETAIL

Trust me when I say this, attention to detail is a must-have in this industry. For example, you’re building a financial model and wrongly typed a depreciation number as $585 in place of $858. This will lead to a completely different answer and a major disaster for everyone involved. Similarly, a change of one per cent in the growth rate or in the discounted cash flow (DCF) model can lead to a complete change in the valuations. Any small error in gathering the data or analyzing the trends can lead to a significant change in its conclusions.

In fact, attention to detail is not just limited to numbers but also related to format and writing style. This is especially important for investment banking clients who are very specific about the kind of format they want. Hence, the presentation format for an investment banking analyst is very important and each deck for a particular client should have the same format.

Want to become an investment banker? Here’s everything you need to know about the investment banking world.

FORWARD-LOOKING

A financial analyst is required to build good relationships with clients as well as supervisors. These relationships will not only foster a great work environment but will also get you promoted. Short term tricks of going for shortcuts and overlooking the value of hard work will not really help you on a longer horizon. Instead, choose to be proactive, sign up for extra activities in the office and spend time outside building relationships.

Our friend Priya has managed to maintain a good rapport with her clients because of her skills and promptness. In fact, one of her clients was so happy with the work done, that he endorsed her strongly which ended up getting her a promotion and raise at a relatively early stage.

Excited to know about all the opportunities available to a financial analyst? Here’s a list of all the career path options.

CONCLUSION

That was a long one. You now know what it takes to be a great financial analyst. Did you tick off the skills you already possess? Great! Now you can devote your time to working on the rest. These are crucial skills to possess, however, even having a few can also make you a quality hire. All these qualities go hand in hand, and the possession of one attribute opens the door to another. Some of these skills can be learned in theory or by studying economics or finance, while the remaining ones will come with experience and hard work. So, buckle up and let’s get down to more upskilling and learning!

Financial Analyst looking like the best career choice? Why don’t you consult the Financial Experts at Proschool, to get started off on the right foot? Just fill out this short form, and we’ll get in touch.

Interested in becoming a pro in Financial Analysis? Read about the CFA Course

Resent Post

>

Best Study Abroad Courses for Commerce Graduates

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

Follow Us For All Updates!