Different approaches to Equity Analysis

Here's What We've Covered!

Let’s say you are out on a holiday and want to head straight to Goa. There can be so many ways to reach there right? Road, Rail or Flight. You choose how you want to go there based on your preferences and priority. If you want to save on travel cost you will opt for rail, if you want to save on travel time a flight would be apt and if you are one of those who just loves long drives, you will surely hit the road.

Equity analysis is a lot like travel! All of us want to choose the best-performing stock but we may have varied approaches to do that. If we broadly classify these approaches, they are (1) Fundamental Analysis and (2) Technical Analysis.

FUNDAMENTAL ANALYSIS

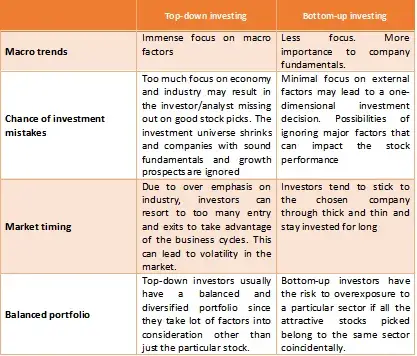

Fundamental Analysis aims to understand and forecast the intrinsic value of stocks based on a thorough analysis of various macro, company-specific as well as qualitative and quantitative factors. There are 2 approaches to fundamental analysis as well. They are Top-Down approach and Bottom-up Approach.

Top-down approach

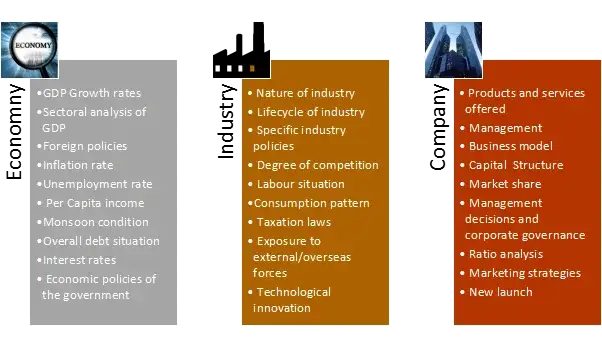

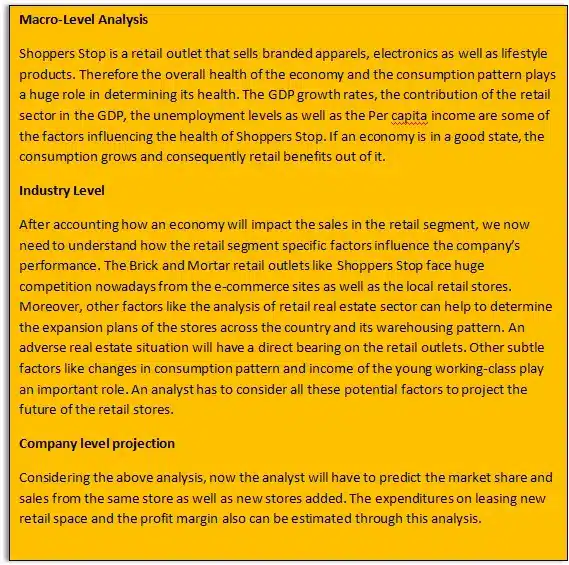

This is also known as the Economy-Industry-Company or the EIC approach wherein the analyst starts analyzing the economy at large and delving down further into the relevant sector and then the company in particular. This approach is one of the most preferred ones by fundamental analysts and provides a holistic view of things. The analyst first analyses the trends makes forecasts for the economy, then he does the same for the particular industry.

Then he picks up the stocks from that industry and follows the same approach for valuing the stocks. The most attractive stocks are then chosen from amongst them for investment purpose.

Let us take an example of Shopper’s Stop as a company and undertake a top-down analysis for the same:

Do you know Investment Banking can be a great career option since you already know about Equity Analysis. Interested?

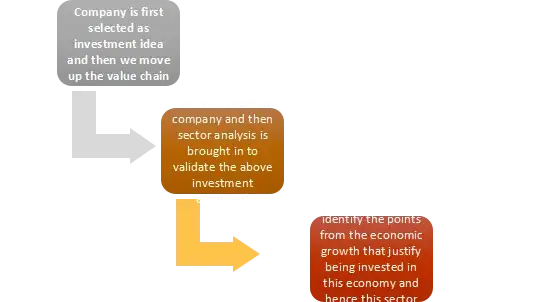

Bottom-up approach

Bottom-up approach is just the opposite of top-down approach. In this approach, the company is analyzed first and then it is validated in the backdrop of the forces of economy and industry. In this, we study the details about the companies such as the financial statements, ratios, management discussion & analysis and estimate its investment potential. The bottom-up approach thrives under the assumption that individual companies can perform well even if the overall economy or industry is not doing well. Bottoms up investors do not ignore macro trends, but they assign more weightage to the performance of the individual company.

However, critics of the Bottom-up approach say that no matter how well a company’s financials are, if there is a massive meltdown in the market all the stocks are bound to be affected by it. But still many asset management companies have successfully used the Bottoms up approach over the years.

A comparative analysis

Market sizing approach

Market sizing approach- Total Size and market shares.

Unlike the Top-down or Bottom-up approach, this is not a straightforward way of company analysis, but it studies the market trend for the company’s product/service in details. The aim of the market sizing approach is to understand the market characteristics and estimate the current market size to identify:

- Market growth in the past 3 years?

- Estimated growth for this market in the next 3 years?

- How can this market be segmented? How does the growth vary by segments? Which segments are most attractively poised for growth?

- Who are the big players? What are their market shares? Which companies constitute the rest of the field?

On doing the above analysis, we can identify the company which can benefit from the given market conditions. This approach is suited and very popular among consumer led stocks where competition is usually high and where consumer behavior can be studied closely.

700+ Core Finance jobs available. Have a look at IMS Proschool’s Investment Banking Course.

TECHNICAL ANALYSIS

This form of analysis is based on the belief that history repeats itself and the pattern that the stock has shown in the past will continue in future. In Technical analysis usually, 3 things are studied: (1) Past Price movements (2) Trading volume (3) Time duration

Technical Analysis is based on certain assumptions:

- The price of a stock is determined by the forces of demand and supply.

- Price movements happen over long term.

- Price fluctuations reflect logical and emotional forces in the market.

- The trends in security prices may change due to shift in demand and supply.

Some of the Technical indicators that are popularly used by analysts are:

- Moving Average

- Rate of Change in Price

- Moving average Convergence-divergence indicators

- Relative Strength indicators

Conclusion: An approach based on long term goals will fetch results

While picking a stock we need to understand that no single approach, whether it Top-down, Bottom-up or Market sizing, is fool proof. To analyze the company’s performance over the long-term, the investor must choose an approach based on his goals and objectives. Moreover, there will be changes in business and economic cycles, so one may need to re-balance his portfolio and choose a different style altogether.

Resent Post

>

Best Study Abroad Courses for Commerce Graduates

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

Follow Us For All Updates!