Financial Modeling and Financial Analysis Explained in a Short Story

Here's What We've Covered!

Aditya has been assigned the task of completing the financial analysis of a project in the next 2 weeks. The assignment was handed over to him today morning since Balaji who was handling the assignment was hospitalized and would be on leave for the next one month. Aditya was assigned this task since he is very comfortable with MS-Excel. However, Aditya is worried since he does not have a background in financial analysis. He decides to take some help from Sandhya, who has worked on these similar projects in the past.

Sandhya begins by explaining the concepts of financial analysis and modeling. “Financial analysis is a general term that refers to an assessment of a business or a project. The assessment is carried out with the intention of either investing in the company or project or lending money to the project. The assessment is required since one would like to take an informed decision about any investment or lending. Financial analysis is typically carried out using ratio and trend analysis of relevant information taken from financial statements and other reports.”

“Financial modeling, on the other hand, is essentially the task of building a model that represents a real world financial situation. Financial Modeling is used to represent the performance of a business or a project. Financial modeling usually relates either to accounting and corporate finance applications, or to quantitative finance applications. As a result, financial modeling is the perfect tool for carrying out financial analysis.”

Do you know that Financial Modelling is the core skill for all finance jobs? Start learning today

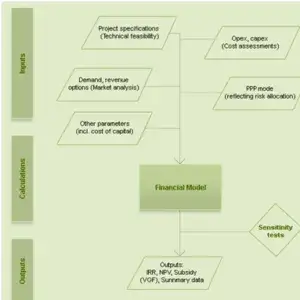

“So the first step, I guess is to build a financial model, right? But where do I get all the information from?“ asked Aditya. Sandhya replied “All the project details have been documented in the financial statements available. You start by populating this historical data that in your spreadsheet model. You can then study the trends and the historical ratios to get an idea of how the business is performing. Once you have a clear picture, you can forecast the values for the future years. You can forecast the revenues and cost for the future based on the planned production for the next few years and trends in the industry.”

“These forecasted figures will guide you in order to carry out ratio analysis. Based on the availability of the different sources of funds, the funding schedule can be created. With such a detailed model in place, you can then evaluate the project return analysis like Net present Value (NPV), Internal Rate of Return (IRR) etc.”

However Aditya looked confused. “But this model is based on assumptions. What if the assumptions are incorrect? The analysis will be flawed in that case.” Sandya said,” Don’t worry. Financial modeling is not an exact science. Since it is a forecasted model, as you rightly said, the assumptions could turn out to be unrealistic. However based on experience, the modeling and assumptions for variables are made in such a way that they allow for some variation. So financial modeling includes what we call “Sensitivity Analysis” – to check variations in the output variables for changes in the assumptions. Using a range of assumptions, we can figure out the worst or the best case scenarios for the project and plan activities for the project accordingly. This leads to risk mitigation planning based on sensitivity analysis. And with your knowledge of MS – Excel, all these modeling aspects can be easily structured by you.”

The last comment from Sandhya was a morale booster for Aditya and he started going through the project documents to understand the project background.

Resent Post

>

Best Study Abroad Courses for Commerce Graduates

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

Follow Us For All Updates!