HOW TO DO INDUSTRY ANALYSIS? A COMPLETE GUIDE WITH STEP-WISE APPROACH AND EXAMPLES

Here's What We've Covered!

Man doesn’t exist in isolation, he is a part of the universe at large. Similarly, companies also do not operate in seclusion. They are a subset of the greater universe known as the industry or sector. For example, pharmaceutical companies such as Cipla, Dr. Reddy’s and Glenmark is a part of the Indian Pharmaceutical industry as a whole. Companies such as ONGC, RIL, BPCL etc belong to the Indian Oil& Gas industry.

We know that Equity Research is much revered and one of the highest paid profiles in the country, but do we know what lays the foundation of a good equity research analyst? A good equity research analyst is the one who analyses the industry thoroughly before studying a particular stock. Before understanding the guiding principles of industry analysis, let us see, why industry analysis is so important.

- Understanding the forces that work in the industry which helps companies and analysts to identify the threats and opportunities that the business is exposed to.

- Assessing the market position, financials and the other developments of a particular company in relation to the others from the same industry.

- Identifying the future trends and directions gives the business required knowledge to react and steer the company in the positive direction.

An analyst must undertake industry analysis with a structured approach, failing which the results of the analysis will not yield the desired result.

(1) Differentiating between industry and sector and identifying the appropriate industry

The first step in beginning the analysis is identifying the correct industry and at the same time, distinguishing between industry and sector. Though used interchangeably, there are differences between the two. While a retail store, FMCG company, Consumer durable all belong to the Indian consumer sector but each of these are from a different industry. Similarly a pharmaceutical company, diagnostic sector as well as a hospital all belong to the healthcare sector, but each of them belong to a different industry which operates on different metrics and dynamics. Hence, identifying the correct industry is imperative to understand these dynamics.

(2) Understanding the forces of demand and supply

To understand an industry you need to have knowledge regarding the total market demand as well as supply for the particular product or service. These forces of demand and supply control the market and are instrumental in studying the trend formed in the industry.

So being an analyst for a particular industry you need to know how to do market sizing with maximum precision, because inaccurate industry forecast can cause grave errors in trend identification and strategic planning.

The Harvard Business Review quotes an example that says: In 1974, U.S. electric utilities made plans to double generating capacity by the mid-1980s based on forecasts of a 7% annual growth in demand. But during the 1975–1985 period, load actually grew at only a 2% rate. Despite the postponement or cancellation of many projects, the excess generating capacity has hurt the industry financial situation and led to higher customer rates.

This does not happen due to improper forecasting techniques, historical trend analysis extrapolation or regression but due to absence of fundamental assumption of market trend wherein demand pattern may change suddenly due to technological advancement, emergence of substitutes or globalization of the industry. Hence, it is very important to include proper assumptions and a degree of flexibility to the forecast mechanism rather than just focussing on mechanical tools.

(3) Identifying the industry life cycle

An industry goes through 4 different cycles viz. introduction, growth, maturity and decline. To analyze an industry we first need to determine at which stage the particular industry is. E-commerce companies will be at a different cycle than an established telecom company. Each stage helps us to know the future prospects and assess the risk-reward metric of the industry. We also need to determine whether the industry is making the most of the stage it is undergoing.

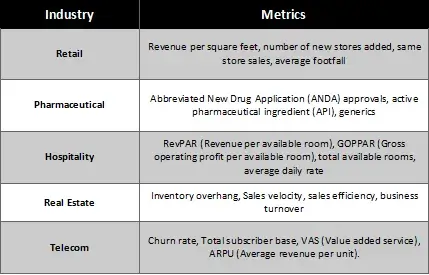

(4) Knowledge of relevant industry metrics

For industry analysis, it is imperative to have in depth knowledge about the industry specific performance metrics. Eg: Real estate companies study metrics like inventory overhang, sales velocity, sold and unsold units, sales efficiency and so on, while telecom companies use These metrics helps an analyst to evaluate where the company stands in relation to other companies in the same industry and how to predict a trend based on this. Some of the widely used industry specific metrics are:

(5) Competitive analysis through Michael Porter

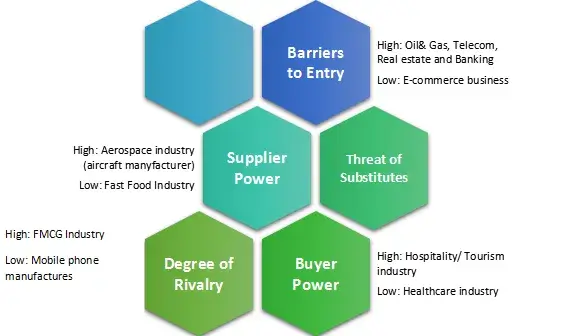

Porter’s 5 forces forms the basis of any competitive analysis in the industry landscape. This model determines the degree of competition in a particular industry and the attractiveness quotient of the industry against the analysis. These 5 forces are:

- Barriers to Entry: Industry which involves high start up cost, plenty of regulatory hurdles, a proprietary technology and high fixed operating costs is referred to as an industry with high barriers to entry. These industries have few large players and less competition, hence huge profit potential. Also they mainly cater to institutional buyers. Eg: Oil& Gas, Telecom and Real estate.

- Supplier Power: This pillar of the Porter’s 5 forces model indicates the degree of control that the suppliers may have over the prices of the goods/raw materials, the quality of the raw materials and its availability. The influence is strong when suppliers are unique and concentrated, there are significant switching cost between suppliers and when they have forward vertical integration. Low bargaining power of supplier makes an industry more attractive and raises profit potential for the companies, high supplier influence makes an industry less attractive and lowers profit potential for the company. Eg: Fast Food industry or the Quick Service Restaurants (QSR) depends on suppliers for raw materials, farm fresh produce, equipment, packaging materials, etc. Such suppliers are plenty in number and have no control over the distribution network. Hence, they are a very weak force for the industry.

- Threat of Substitutes: The perfect example of this is the beverage and soda industry in India. We all know about the eternal cola wars between Pepsi and Coca Cola. Now there are many more fruit juice, tonic water and energy drinks manufacturers who have joined the bandwagon. These products are perfect substitutes of each other with few differencing features hence it offers huge options to customers. Such industries always have huge marketing costs to ward of severe competition. The only way companies can survive is showcasing a unique brand image and ensuring global presence and devising new customer engagement strategies. On the other, look at the hand Aviation sector. Airlines offer a unique travelling experience and time convenience which cannot be substituted by bus, train or road. Hence they charge a premium and enjoy higher returns.

- Buyer Power: Bargaining power of customers is the degree of influence that the buyers can exert to get the best deal from the companies. A strong force on the buyer front can make the industry more competitive and reduce profit potential. We can take an example of hospitality/tourism industry in this case. Many tour operators (domestic and international) have bulk bookings in the hotels for their customers and this gives them an opportunity to negotiate the rates. The hotels on the other hand are bound to oblige because they operate in a seasonal industry and their earning potential reduces drastically once the peak holiday season is over.

- Degree of Rivalry: If the degree of competition in a particular industry is too intense then the companies will resort to aggressive marketing campaigns, price cuts and other promotional tactics to pull each other’s customers. In this situation, the suppliers and customers have a lot of scope to shift their preferences as they have too many options. The profit margins of these companies are usually lower. A perfect example of this is the FMCG industry. On the other hand, the industry where competitive forces are minimal or there are a few companies in the industry and each offers a unique product or service then the stability quotient is higher. Each company has a large market share and yields more profit. Such an industry is also called fragmented industry. However, this high profit may attract more players in the industry and lead to competition eventually. Example: Mobile phone manufactures. While Samsung, Apple, Motorola and Micromax all manufacture mobile phones, each of them offer a different product and cater to distinct classes of buyers.

(6) Reading available reports

An analyst must go through the available reports of the relevant industry to get an idea as to how the developments have panned out over a period of time. It is not advisable though to depend on the existing reports alone as industries change over a period of time. Needless to say, the information available in the industry research reports should be absolutely latest, otherwise it would not show the findings in true light. Some of the sources where you can find reliable and informative industry reports are IBIS World, IBEF, stock broking companies like Motilal Oswal, Sharekhan, IIFL, Euromonitor international, Dun and Bradstreet, CRISIL, EY, KPMG, PWC etc.

A structured approach is the key

Though the above mentioned guidelines forms the basis of industry analysis, what differentiates a good analysis from an ordinary one is the approach. A structured approach is the key. As an analyst you may be aware of the various things on your checklist for the analysis, but conducting the research in a chronological way, observing the trend and finally presenting them in a report format with proper findings, data and tables and text is a feat that is possible only with due practise and thorough knowledge of the industry dynamics.

Resent Post

>

Best Study Abroad Courses for Commerce Graduates

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

Follow Us For All Updates!