ACCA Or MBA, which is better?

Here's What We've Covered!

You are not alone if your mind has been troubled by the classic commerce confusion – ACCA or MBA?

Actually, it is a matter of common debate among commerce students – which course is better, ACCA or MBA? It is natural enough, since both are financially rewarding titles and can lead to prestigious job profiles in the corporate world.

However, lack of in-depth understanding is the prime reason behind the confusion prevailing in the minds of students and parents. At the same time, it is important to make the right choice, since the program you opt for will have a profound impact on your career, and perhaps your life, too. This article analyzes both programs in detail and provides a concrete guideline that will help you make the right choice.

Let’s first have a quick look at each of the two programs.

All About ACCA

-

Quick Info

ACCA is the acronym for the Association of Chartered Certified Accountants. It is a globally recognized professional accounting body that offers qualifications and certifications for individuals aspiring to become versatile professionals in accounting and finance. Covering various aspects of finance, accounting, management, and taxation, ACCA will enlighten you with the nuances of financial reporting, audit and assurance, taxation, and more.

-

Eligibility for ACCA

- Candidates must have passed their class 10+2 from a recognized board

- Candidates must have scored 65% marks in 2 subjects out of five including Accounts and Mathematics, and minimum 50% in the remaining 3

- Higher secondary certificate holders must score over 130 marks from 200 to be eligible to take the ACCA 2023 course

- Candidates pursuing graduation in Commerce i.e. B.Com, BBA, BMS are also eligible to take up ACCA exams

- BA/B.Sc. graduates from a recognized university can also take up the ACCA course, but they will have to take the ACCA Foundation diploma first

-

Program Structure

There are three milestones in the journey to gaining an ACCA membership viz:

-

- ACCA exams

- An Ethics and Professional Skills module

- A Practical Experience Requirement

ACCA Exams comprise three levels viz Applied Knowledge Exam, Applied Skills Exam, and Strategic Professional Exam.

Applied Knowledge Exam comprises:

-

- Business and Technology (BT)

- Financial Accounting (FA)

- Management Accounting (MA)

Applied Skills Exam consists of:

-

- Corporate and Business Law (LW)

- Taxation (TX)

- Financial Reporting (FR)

- Performance Management (PM)

- Financial Management (FM)

- Audit and Assurance (AA)

Applied Strategic Professional Exam consists of:

-

- Strategic Business Reporting (SBR)

- Strategic Business Leader (SBL)

-

Course Syllabus

- Knowledge Level – Business and Technology (BT), Management Accounting (MA), and Financial Accounting (FA)

- Skill Level – Corporate and Business Law (LW), Performance Management (PM), Taxation (TX), Financial Reporting (FR), Audit and Assurance (AA), and Financial Management (FM)

- Professional Level

- Essentials – Strategic Business Reporting (SBR – INT), Strategic Business Leader (SBL)

- Optional (2 of 4) – Advanced Audit & Assurance (AAA – INT), Advanced Performance Management (APM), Advanced Taxation (ATX – UK), and Advanced Financial Management (AFM)

Did you know, Proschool has over 71% pass rate for ACCA exams?

-

Study Focus

ACCA is a specialized program that focuses solely on accounting and finance; this certification will provide you with a more specialized skill set as an accountant.

-

How to Prepare

The Global Professional Accountant (GPA) course from IMS Proschool is a comprehensive program designed for students aspiring to pursue ACCA. It has a triple advantage: A strong focus on ACCA pass rate; additional skills like financial modeling to get you job-ready, and dedicated placement assistance.

So, not only do you get quality learning content and qualified faculty from the industry, but you also get an additional Financial Modeling certification, access to Job Portal and placement/internship assistance.

Also Read – 5 incredible advantages of an ACCA qualification

-

Salary Spectrum

The average ACCA salary in India is INR 8 LPA. While candidates working in entry-level positions, such as Accountants, draw a salary in the range INR 3-4 LPA, those professionals working as Chartered Accountants, get a handsome package of INR 9-10 LPA.

-

Employability

Apart from the Big4, viz KPMG, EY, PwC, and Deloitte, several MNCs such as Tata Grant Thornton, PepsiCo, Accenture, HSBC, seek out ACCA qualified candidates to effectively look after their accounting and finance function.

Also Read – What is the cost of doing ACCA in India? ACCA Fees structure

All About MBA

-

Quick Info

MBA is the most sought after post graduate degree in business administration. From the technical standpoint, MBA is not a certification but an academic degree offered by around 1,100 institutes across India.

The curriculum for MBA focuses on inculcating managerial and entrepreneurial skills in students. MBA subjects cover a wide range of topics such as Managerial Economics, Accounting for Management, Business Communication, Information Technology Management, Marketing Management, etc.

-

Eligibility

- A bachelors’ degree of minimum 3-Years after 10+2 examination, from a recognized board with a minimum aggregate of 50%

- Candidates in the final year of graduation are also eligible, provided they have a certificate from the head of the college

- A valid cut-off score of CAT/GMAT

-

Program Structure

A regular, full-time MBA is a two-year course divided into four or six semesters, which includes theory classes, practical projects, student exchange programmes, summer internships, and final placements.

-

Study Focus

An MBA program covers a range of business topics such as management, marketing, operations, human resources, and accounting.

-

How to Prepare

If you are a professional employed in an organization and plan to pursue an MBA along with your current job, IMS Proschool offers Mini-MBA qualifications which are equivalent to regular MBAs that you can pursue and leverage the benefit of amazing job opportunities in just a few months.

On the other hand, if you are a commerce student studying in XII or who has passed XII and looking to pursue an MBA, then Proschool’s CCMP will provide you with the right advice and guidance in the matter. To know more about CCMP, please click here.

-

Salary Spectrum

An MBA candidate, placed in a renowned organization, draws a salary in the range of INR 5 lac to 25 lac per annum.

-

Employability

Top recruiters for MBA candidates include Boston Consulting Group, Mckinsey, Bain & Co, Morgan Stanley, Citibank, JP Morgan Chase, Amazon, Facebook, Google, and Adobe, among others.

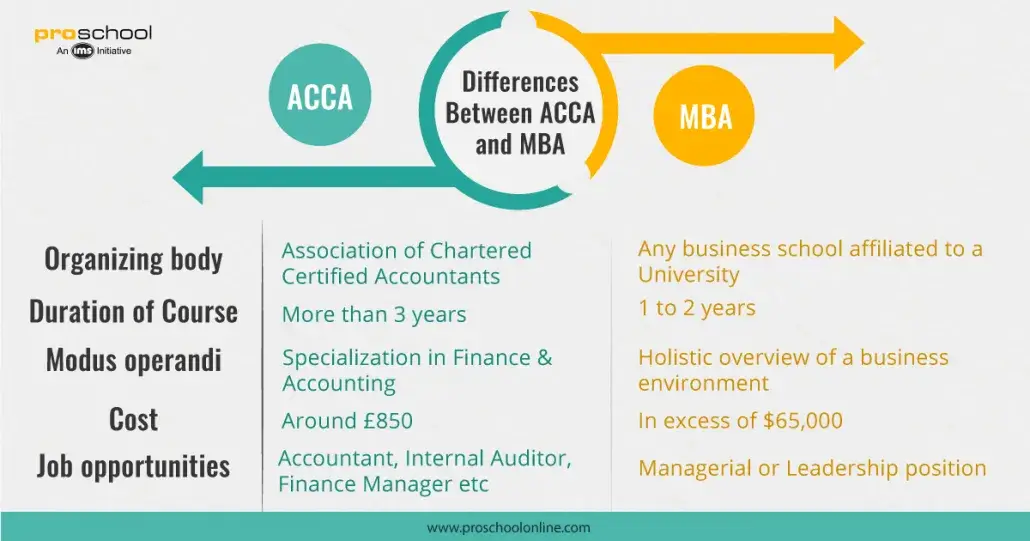

ACCA or MBA – Course Comparison

The following table highlights the key points of difference between ACCA and MBA:

| Parameter | ACCA | MBA |

| Definition | ACCA is an international accountancy qualification for students who wish to practice accountancy. | The MBA program is a postgraduate degree that offers a thorough understanding of business and management. |

| Organizing Body | The ACCA certification is offered by the Association of Chartered Certified Accountants. | Government-recognized business schools offer the MBA program to graduate students. |

| Course Duration | This course can be completed in 6 months to 2 years. | The duration for the full-time regular MBA degree is two years. |

| Program Focus | The ACCA program provides specialized expertise in accountancy and finance. | The MBA degree provides a holistic overview of the entire business world. |

| Approximate Cost | The average cost for the whole ACCA course is around $4,500. | An MBA degree from a top business school can cost over $50,000. |

| Global Job opportunities | Some of the job profiles available to an ACCA include –Accountant, Finance Manager, Taxation Manager, Internal Auditor, Financial Consultant | Some of the global job profiles you can acquire after MBA include – Financial Planner, Investment Banker, Insurance Specialist, Financial Manager, Commercial Banker |

| Exams | The ACCA course can have up to 13 exams depending on the previous qualification. | Most institutes divide the course into semesters (4 semesters). While the other uses a trimester format for MBA exams (6 exam levels). |

| Salary Range | The starting salary an ACCA professional draws is around 8-15 lakh per annum, which can grow with experience in later years. | An MBA fresher can earn an average of 4-10 lakhs per annum. |

| Flexibility | ACCA is quite flexible for both undergraduate students and working finance professionals. ACCA also has a low entry barrier; you can pursue it after your 10th with the Foundation in Accountancy (FIA) course. | The MBA programs are rather rigid in their structure. You have to complete the whole program generally in 2 years, making it tough for working professionals. |

Who Should Prefer ACCA Over MBA?

ACCA is better suited for you than MBA if:

- You have a solid accounting background and a desire to pursue a career in accounting and commerce

- You already possess a B.Com, CA, or any other accounting degree and wish to advance your accounting career

- You are already employed in the finance or accounting sector and want to consolidate your domain knowledge

Who Should Prefer MBA Over ACCA

MBA is better suited for you than ACCA if:

- You aspire to work in managerial or leadership capacity

- You have the natural interest to become an entrepreneur

- You would like to apply your financial knowledge and skills to manage a company’s assets, including taxation, financial statement analysis, and reporting

Proschool – the Right Choice of Bright Students!

The Global Professional Accountant (GPA) course from IMS Proschool is a comprehensive program designed for students aspiring to pursue ACCA.

The growing popularity of GPA among students and parents is its unique triple advantage:

- A strong focus on the ACCA pass rate

- Additional skills like financial modeling to get you job-ready

- Superb placement assistance

So not only do you gain quality learning content and qualified faculty from the industry, but you also get an additional Financial Modeling certification, access to our Job Portal, and reliable placement/internship assistance.

Resent Post

>

Emerging commerce career options in India (2026): From CA to Data Analyst

>

ACCA Opportunities You Didn’t Know About – Think Beyond Audit!

>

Which Courses After 12th Commerce With High Salary Are in Demand Worldwide?

>

How to Find ACCA Jobs Online After Qualifying: Real Portals, Tips & Career Guidance

>

Financial Modelling Classes in Hyderabad: Your Guide to the Best Institutes

Follow Us For All Updates!